Egypt Analysis: Government likely to maintain political stability with widespread civil unrest unlikely, despite economic decline

Executive Summary

- The Egyptian economy has experienced a downturn over recent months, characterized by rising inflation. The Russia-Ukraine conflict exacerbated long-term economic structural issues as it disrupted global supply chains and increased the price of imports, particularly wheat. This exposed Egypt’s vulnerability to market price volatility and dependence on certain imports.

- Egypt’s foreign exchange reserves have also been depleted because of higher import costs, diminished foreign investment, and the loss of income due to reduced tourism. This trend is likely to persist due to global inflationary trends.

- Egypt sought an IMF loan in May and is likely to make structural economic reforms required for the release of funds, including austerity measures, the privatization of state-owned firms, and subsidy cuts.

- Such reforms are liable to impact poorer segments of society and will further increase socio-economic grievances. This is despite the government also taking economic and political steps to project attentiveness and prevent a large-scale socio-economic crisis.

- The prospect of widespread civil unrest and political instability is unlikely. This is due to the Egyptian government’s low tolerance toward protest activity, the absence of mobilizing groups, and attempted censorship of anti-government online sentiment. That said, dissent is likely to be expressed online and labor disputes prompting strikes may affect specific companies.

Current Situation

Macroeconomic Developments and Indicators

- On May 15, the Egyptian government announced its privatization roadmap including the “state ownership policy”, which aims to increase the proportion of investment made by the private sector from 30 percent to 65 percent.

- On June 21, the Egyptian Parliament passed Egypt’s budget for the financial year 2022-23, with an expenditure outlay of 2.07 trillion EGP (111 billion USD) and a deficit of 558.2 billion EGP.

- Egypt’s Purchasing Manager’s Index for the non-oil private sector, which measures the performance of other sectors through five separate indexes and a survey of 450 companies, recorded its lowest level in June 2022.

- The IMF stated in July, during negotiations with Egypt for a fresh loan, that “decisive progress on deeper fiscal and structural reforms was needed to boost the economy’s competitiveness”.

- According to data released by the Central Agency for Public Mobilization and Statistics (CAPMAS), Egypt’s unemployment rate registered a decrease of 0.2 percent in the first quarter of 2022 to 7.2 percent, compared to the last quarter of 2021 which stood at 7.4 percent. This figure remained stable at 7.2 percent through the second quarter of 2022.

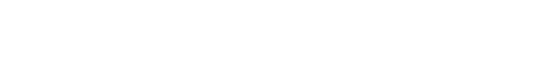

- Egypt recorded an annual inflation rate of 13.6 percent in July 2022, according to CAPMAS.

Socioeconomic Developments

- On July 13, Egypt’s Fuel Automatic Pricing Committee announced fuel hikes for gasoline and diesel to account for the increase in global oil prices. This move follows previous hikes in the price of gasoline in February and April and marked the first hike in the price of diesel since 2019.

- On August 8, truck drivers across Egypt held a nationwide strike protesting increased taxes, along with high diesel and spare part prices.

- On August 9, Egypt’s Prime Minister announces measures to ration electricity use in Egypt in order to cut down on the consumption of natural gas.

Political Developments

- On August 13, Egypt’s Parliament approved a cabinet reshuffle and appointed 13 new ministers in a move aimed at improving the government’s performance.

- On August 17, Tarek Amer resigned as governor of the Central Bank of Egypt (CBE) a year before the end of his term. Hassan Abdullah was appointed as acting CBE governor on August 18 and was reportedly directed by President Abdel Fatah al-Sisi to work on diversifying sources of foreign currency and fostering the necessary economic climate for increased investments.

Economic Situation in Egypt

Inflation, triggered primarily by Russia-Ukraine conflict, to erode purchasing power of households

- The immediate causes of Egypt’s rising inflation rate can be attributed to high global energy prices and the reduced global supply of wheat due to the Russia-Ukraine conflict. Egypt is particularly vulnerable to price shocks from external markets due to its dependency on imports for wheat, with estimates indicating that Egypt was dependent on Russia and Ukraine for 80 percent of the commodity at the outset of the conflict. The instability of oil prices has also threatened Egypt’s prior export gains and oil trade surplus. The decision to increase diesel prices in this quarter thus indicates a growing strain on Egyptian state finances and its ability to maintain its fuel subsidy program. Given that diesel is the primary fuel for mass transit, railways, and freight, this development immediately resulted in the revision of public transport fares. Similarly, the decision taken by some heavy transport drivers to protest was triggered by higher operating costs due to the diesel price hike.

- The CBE has kept interest rates relatively high, with the main operation rate standing at 11.75 percent. While the CBE hiked interest rates earlier this year for the first time since 2017 to slow down inflation, this has not had the desired impact given the inflation rate’s currently increasing trajectory. FORECAST: High inflation is likely to erode the purchasing power of Egyptian households in the short term. This is likely to be accentuated by the Egyptian government’s long-term intention to transfer subsidies to only Egypt’s most vulnerable individuals and eventually phase out subsidies. Any drastic measure to phase out subsidies will disproportionately impact people of the lower socio-economic strata. The phasing out of subsidies will thus likely occur gradually as the government works to identify the most vulnerable beneficiaries. Everyday essentials such as bread, electricity, and fuel will likely remain subsidized by the Egyptian government for the foreseeable future.

Declining foreign exchange reserves to exacerbate economic conditions

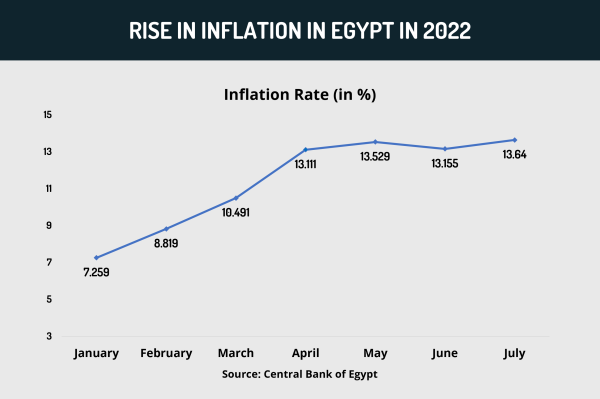

- Egypt has recorded a declining trend in foreign exchange reserves since February 2022. This is due to the increased cost of imports and debt servicing as well as the need to utilize reserves to subsidize goods and public services. To counter the trade losses on account of a higher volume of imports, the Central Bank introduced new import rules in March. These stipulated that importers, barring foreign companies and subsidiaries, would have to supply banks with letters of credit to purchase foreign goods. This measure was aimed at limiting imports to stem the outflow of foreign exchange.

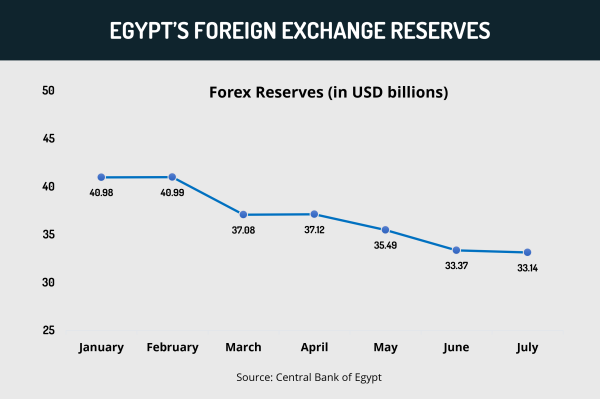

- Shrinking foreign exchange reserves are an indicator of Egypt’s reduced ability to generate foreign income. This could point to declining exports, an inability to attract foreign investment, and a drop in income from tourism. Per World Bank data, Egypt’s exports have been in decline since 2019. While a dip in 2020 can be attributed to the pandemic, Egypt did not experience a rise in 2021 like that of other North African economies, which indicates declining Egyptian export competitiveness. In terms of foreign investment, there has been an outflow of foreign exchange, with investors from developed countries reportedly withdrawing an estimated 4-7 billion USD in capital from Egypt due to increased interest rates in their home countries as a result of global inflationary pressures. Meanwhile, tourists from Russia and Ukraine accounted for 40 percent of arrivals to Egypt prior to Russia’s military operation. The conflict has thus deprived Egypt of a significant source of foreign exchange. This challenge is likely to persist given that the conflict is ongoing and citizens from both countries are experiencing economic hardships. Moreover, continued sanctions targeting Russia mean that even in the event of a return of Russian tourists, an inflow of the ruble will not mitigate Egypt’s foreign exchange losses as few countries will accept it as a currency for trade.

- Overall, further declines in foreign exchange reserves are likely to constrain Egypt’s ability to import critical goods. As a result, Egypt will thus be forced to consider new means of raising foreign exchange to service its debts and finance its economy. The Russia-Ukraine conflict thus also presents an opportunity, with countries in Europe seeking to diversify their oil and gas sources amid continued sanctions on Russia’s energy sector. FORECAST: Cairo will likely make efforts to capitalize on the increased demand and global price of hydrocarbons in order to expand foreign exchange reserves. This was evidenced by the recent decision to reduce domestic electricity consumption to channel the gas that is used to fuel the domestic electricity grid towards exports. The Egyptian government will also likely attempt to attract investment to the energy sector to boost exports to Europe.

Impact of Economic Situation on Policy

Necessity of IMF loan likely to pressure government to implement austerity measures

- Egypt sought a loan from the IMF in May citing economic difficulties due to the Russia-Ukraine conflict. If this loan is granted, it will mark Cairo’s third IMF loan since 2016. Egypt’s total foreign debt reached 157 billion USD in March, an unsustainable level. The increased urgency of this issue can be seen in Egypt’s allocation towards debt servicing in its latest budget, where 45.4 percent of the budget is devoted to servicing its loans, an increase of 0.8 percent from 2021. This also reflects the fact that Egypt is due to begin repayments on its IMF loans from September 2023.

- FORECAST: The Egyptian government is likely to continue reforms in line with the IMF’s recommendations for structural adjustment in order to be eligible for a new IMF loan. These measures are likely to include the reduction of subsidies and other austerity measures, such as a reduction in the number of citizens employed by the public sector, which stood at 695,000 in 2021. In the context of these overall reforms, the resignation of the CBE governor in August was likely not voluntary but prompted by President Sisi. This is given the former’s reported opposition to certain IMF conditions, such as a more comprehensive liberalization of the Egyptian currency exchange rate against foreign currencies and privatization of the economy.

- FORECAST: Despite the IMF’s statement about the need for Egypt to make progress on fiscal and structural reforms, it is likely that it will grant Egypt’s application for the loan. Based on the IMF’s 2021 assessment of Egypt, the organization is seemingly satisfied with Egypt’s pace of reforms to become a more market-oriented economy and has praised Egypt for its fiscal discipline. The IMF is also likely to consider the shocks caused by the Russia-Ukraine conflict on the economy as an extenuating circumstance while granting the loan.

- In a bid to demonstrate fiscal prudence and reduce its subsidy burden, the government will likely accelerate the transition to targeted subsidy programs. Indications can already be seen in the government’s decision to revoke ration cards for 500,000 people on the grounds that they were drawing high monthly salaries and owned expensive vehicles. However, further subsidy reductions and cutbacks on social spending will likely intensify socio-economic strain, particularly on the poorer segments of society. FORECAST: While the government will likely state that subsidies will continue under a targeted program for the poorest, such cash transfer programs take time to be implemented due to bureaucratic obstacles. This may result in a sizeable proportion of the population remaining without assistance in the interim.

Government to make increased efforts to privatize public sector, seek Gulf investment

- Egypt has made efforts to privatize key state-owned enterprises (SOEs) to monetize assets and attract foreign investors. The Egyptian government expects to raise up to ten billion USD over four years. This move was also likely aimed to make Egypt more compliant with IMF conditions, which include efficiency changes to the underperforming public sector, and making Egypt more investor-friendly. The firms that have been listed include sectors such as fish farming, livestock, furniture, and fertilizer. This move may help mitigate Egypt’s expenditure on maintaining unprofitable SOEs and reduce future liabilities.

- FORECAST: However, given that the Egyptian government has announced privatization plans several times in the past without proper execution, it is possible that these measures may be delayed and not be implemented per the timeline. Additionally, the World Bank ranked Egypt 114 out of 190 countries in 2019 for “ease of doing business”. This is due to bureaucratic obstacles and corruption, which may deter private entities from investing in SOEs. Thus, despite the ambitious target, it is unlikely that the sale of state enterprises will yield sufficient revenue to pay off debts in the immediate future.

- FORECAST: The private sector is likely to underperform in the short-to-medium term as a result of inflation and the devaluation of the Egyptian pound, which has driven up the costs of inputs and imports, respectively. Combined with reduced demand within Egypt, this will likely adversely impact the sector, which may favor layoffs to mitigate diminished earnings.

- Meanwhile, since the onset of the Russia-Ukraine conflict, Egypt has received significant aid and investment from Gulf countries including Qatar, Saudi Arabia, and the UAE. This aid is likely motivated by the perception of Egypt as a stabilizing regional force and the necessity to prevent any unrest as a result of the deterioration of socio-economic conditions. That said, Gulf investments tend to be focused on firms that are already profitable, indicating that the investments are unlikely to be equitably spread across sectors of the Egyptian economy. FORECAST: These developments indicate that aid may be conditional, limited in nature, and unlikely to be a long-term solution to the structural challenges of the Egyptian economy. Furthermore, such investment may deepen Egypt’s dependence on Gulf intervention in the medium-to-long term.

Impact on Security Situation

Deterioration of socio-economic conditions unlikely to trigger widespread unrest, impact political stability

- While socio-economic grievances will likely increase the level of public dissatisfaction with the government, the probability of mass civil unrest remains low for several reasons. Protests have been effectively banned by the government since 2013, with the government cracking down on alleged violators. This includes the reported arrest of prominent political activists, which demonstrates the government’s resolve to minimize the mobilizing abilities of opposition groups. State censorship of cyberspace will likely also prevent any anti-government sentiment from being amplified or reflected in public spaces. These measures overall deter political mobilization against the government.

- The Egyptian government also faces no major organized political opposition. As a result, unpopular decisions are unlikely to be challenged. The largest opposition group, the Muslim Brotherhood-affiliated Freedom and Justice Party, has also lost its mobilizing capabilities due to frequent crackdowns by Egyptian authorities. It is thus unable to mobilize Egyptian citizens against the government. Similarly, while labor disputes are likely to increase over the coming months, they are likely to remain localized. The risk of accompanying civil unrest is low since Egypt does not have influential labor unions or civil society organizations which enjoy high mobilizing power.

- The government has also taken steps to contain grievances. For example, Egyptian authorities deferred a decision to hike electricity tariffs by six months in July, despite the added burden to the economy of 533 million USD. On September 1, the government also increased announced an increase from a monthly payment of 100 EGP to 300 EGP for nine million citizens for a six-month period and an increase in bread subsidies by 23 billion EGP to ensure food security. While these decisions exacerbate Egypt’s debt situation, this is also a means for the government to placate the public, thereby mitigating the risk of unrest. Similarly, the government has replaced political leadership to signal a commitment to improving governance. In August, President Sisi ordered a cabinet reshuffle, likely to project the government as accountable and sympathetic to citizens’ hardships.

- Nonetheless, some protests have been recorded in recent months. Most of these have been against specific firms over non-payment of wages and other labor disputes. Anti-government protests have largely been about the non-resolution of localized disputes. To that end, local authorities have been the target of the anger by residents rather than the national government. That said, the relative lack of visible protest activity does not indicate that anti-government sentiment is absent in the country. Many Egyptian citizens have taken to social media to express their dissatisfaction with the increasing socio-economic pressures and the role of government. Social media will remain a space for grievances despite the crackdown on protest activity by the government. While this may not be as disruptive as physical protests, it could potentially serve as a tool for mobilization, which increases the possibility of anti-government protests.

- FORECAST: Despite elevated socio-economic grievances and public frustration, the government is expected to remain politically stable. Authorities are likely to remain vigilant of any protest activity and will clamp down on any possible indications of protest, including on social media. Protest activity is likely to be more localized and targeted at local authorities, especially in the absence of any nationwide movement to oppose the government. The government may resort to censorship of media and the disruption of social networks to prevent popular mobilization. More frequent instances of labor action against companies are likely in the coming months, especially during periods of higher inflation. This is because workers are likely to demand higher wages to compensate for eroding purchasing power.

Recommendations

- Those operating or residing in Egypt are advised to remain cognizant of the overall elevated potential for protests and labor action resulting from rising inflation and socio-economic grievances.

- Refrain from posting any anti-government content on social media, including implied criticism of the government’s accountability for price hikes or food shortages. Egyptian authorities monitor cyberspace for online activity and may detain individuals, including foreign nationals, for perceived dissent.

- Remain cognizant of the potential for increased violent criminal activity and petty crime across Egypt as a result of deteriorating socio-economic conditions.

Executive Summary

- The Egyptian economy has experienced a downturn over recent months, characterized by rising inflation. The Russia-Ukraine conflict exacerbated long-term economic structural issues as it disrupted global supply chains and increased the price of imports, particularly wheat. This exposed Egypt’s vulnerability to market price volatility and dependence on certain imports.

- Egypt’s foreign exchange reserves have also been depleted because of higher import costs, diminished foreign investment, and the loss of income due to reduced tourism. This trend is likely to persist due to global inflationary trends.

- Egypt sought an IMF loan in May and is likely to make structural economic reforms required for the release of funds, including austerity measures, the privatization of state-owned firms, and subsidy cuts.

- Such reforms are liable to impact poorer segments of society and will further increase socio-economic grievances. This is despite the government also taking economic and political steps to project attentiveness and prevent a large-scale socio-economic crisis.

- The prospect of widespread civil unrest and political instability is unlikely. This is due to the Egyptian government’s low tolerance toward protest activity, the absence of mobilizing groups, and attempted censorship of anti-government online sentiment. That said, dissent is likely to be expressed online and labor disputes prompting strikes may affect specific companies.

Current Situation

Macroeconomic Developments and Indicators

- On May 15, the Egyptian government announced its privatization roadmap including the “state ownership policy”, which aims to increase the proportion of investment made by the private sector from 30 percent to 65 percent.

- On June 21, the Egyptian Parliament passed Egypt’s budget for the financial year 2022-23, with an expenditure outlay of 2.07 trillion EGP (111 billion USD) and a deficit of 558.2 billion EGP.

- Egypt’s Purchasing Manager’s Index for the non-oil private sector, which measures the performance of other sectors through five separate indexes and a survey of 450 companies, recorded its lowest level in June 2022.

- The IMF stated in July, during negotiations with Egypt for a fresh loan, that “decisive progress on deeper fiscal and structural reforms was needed to boost the economy’s competitiveness”.

- According to data released by the Central Agency for Public Mobilization and Statistics (CAPMAS), Egypt’s unemployment rate registered a decrease of 0.2 percent in the first quarter of 2022 to 7.2 percent, compared to the last quarter of 2021 which stood at 7.4 percent. This figure remained stable at 7.2 percent through the second quarter of 2022.

- Egypt recorded an annual inflation rate of 13.6 percent in July 2022, according to CAPMAS.

Socioeconomic Developments

- On July 13, Egypt’s Fuel Automatic Pricing Committee announced fuel hikes for gasoline and diesel to account for the increase in global oil prices. This move follows previous hikes in the price of gasoline in February and April and marked the first hike in the price of diesel since 2019.

- On August 8, truck drivers across Egypt held a nationwide strike protesting increased taxes, along with high diesel and spare part prices.

- On August 9, Egypt’s Prime Minister announces measures to ration electricity use in Egypt in order to cut down on the consumption of natural gas.

Political Developments

- On August 13, Egypt’s Parliament approved a cabinet reshuffle and appointed 13 new ministers in a move aimed at improving the government’s performance.

- On August 17, Tarek Amer resigned as governor of the Central Bank of Egypt (CBE) a year before the end of his term. Hassan Abdullah was appointed as acting CBE governor on August 18 and was reportedly directed by President Abdel Fatah al-Sisi to work on diversifying sources of foreign currency and fostering the necessary economic climate for increased investments.

Economic Situation in Egypt

Inflation, triggered primarily by Russia-Ukraine conflict, to erode purchasing power of households

- The immediate causes of Egypt’s rising inflation rate can be attributed to high global energy prices and the reduced global supply of wheat due to the Russia-Ukraine conflict. Egypt is particularly vulnerable to price shocks from external markets due to its dependency on imports for wheat, with estimates indicating that Egypt was dependent on Russia and Ukraine for 80 percent of the commodity at the outset of the conflict. The instability of oil prices has also threatened Egypt’s prior export gains and oil trade surplus. The decision to increase diesel prices in this quarter thus indicates a growing strain on Egyptian state finances and its ability to maintain its fuel subsidy program. Given that diesel is the primary fuel for mass transit, railways, and freight, this development immediately resulted in the revision of public transport fares. Similarly, the decision taken by some heavy transport drivers to protest was triggered by higher operating costs due to the diesel price hike.

- The CBE has kept interest rates relatively high, with the main operation rate standing at 11.75 percent. While the CBE hiked interest rates earlier this year for the first time since 2017 to slow down inflation, this has not had the desired impact given the inflation rate’s currently increasing trajectory. FORECAST: High inflation is likely to erode the purchasing power of Egyptian households in the short term. This is likely to be accentuated by the Egyptian government’s long-term intention to transfer subsidies to only Egypt’s most vulnerable individuals and eventually phase out subsidies. Any drastic measure to phase out subsidies will disproportionately impact people of the lower socio-economic strata. The phasing out of subsidies will thus likely occur gradually as the government works to identify the most vulnerable beneficiaries. Everyday essentials such as bread, electricity, and fuel will likely remain subsidized by the Egyptian government for the foreseeable future.

Declining foreign exchange reserves to exacerbate economic conditions

- Egypt has recorded a declining trend in foreign exchange reserves since February 2022. This is due to the increased cost of imports and debt servicing as well as the need to utilize reserves to subsidize goods and public services. To counter the trade losses on account of a higher volume of imports, the Central Bank introduced new import rules in March. These stipulated that importers, barring foreign companies and subsidiaries, would have to supply banks with letters of credit to purchase foreign goods. This measure was aimed at limiting imports to stem the outflow of foreign exchange.

- Shrinking foreign exchange reserves are an indicator of Egypt’s reduced ability to generate foreign income. This could point to declining exports, an inability to attract foreign investment, and a drop in income from tourism. Per World Bank data, Egypt’s exports have been in decline since 2019. While a dip in 2020 can be attributed to the pandemic, Egypt did not experience a rise in 2021 like that of other North African economies, which indicates declining Egyptian export competitiveness. In terms of foreign investment, there has been an outflow of foreign exchange, with investors from developed countries reportedly withdrawing an estimated 4-7 billion USD in capital from Egypt due to increased interest rates in their home countries as a result of global inflationary pressures. Meanwhile, tourists from Russia and Ukraine accounted for 40 percent of arrivals to Egypt prior to Russia’s military operation. The conflict has thus deprived Egypt of a significant source of foreign exchange. This challenge is likely to persist given that the conflict is ongoing and citizens from both countries are experiencing economic hardships. Moreover, continued sanctions targeting Russia mean that even in the event of a return of Russian tourists, an inflow of the ruble will not mitigate Egypt’s foreign exchange losses as few countries will accept it as a currency for trade.

- Overall, further declines in foreign exchange reserves are likely to constrain Egypt’s ability to import critical goods. As a result, Egypt will thus be forced to consider new means of raising foreign exchange to service its debts and finance its economy. The Russia-Ukraine conflict thus also presents an opportunity, with countries in Europe seeking to diversify their oil and gas sources amid continued sanctions on Russia’s energy sector. FORECAST: Cairo will likely make efforts to capitalize on the increased demand and global price of hydrocarbons in order to expand foreign exchange reserves. This was evidenced by the recent decision to reduce domestic electricity consumption to channel the gas that is used to fuel the domestic electricity grid towards exports. The Egyptian government will also likely attempt to attract investment to the energy sector to boost exports to Europe.

Impact of Economic Situation on Policy

Necessity of IMF loan likely to pressure government to implement austerity measures

- Egypt sought a loan from the IMF in May citing economic difficulties due to the Russia-Ukraine conflict. If this loan is granted, it will mark Cairo’s third IMF loan since 2016. Egypt’s total foreign debt reached 157 billion USD in March, an unsustainable level. The increased urgency of this issue can be seen in Egypt’s allocation towards debt servicing in its latest budget, where 45.4 percent of the budget is devoted to servicing its loans, an increase of 0.8 percent from 2021. This also reflects the fact that Egypt is due to begin repayments on its IMF loans from September 2023.

- FORECAST: The Egyptian government is likely to continue reforms in line with the IMF’s recommendations for structural adjustment in order to be eligible for a new IMF loan. These measures are likely to include the reduction of subsidies and other austerity measures, such as a reduction in the number of citizens employed by the public sector, which stood at 695,000 in 2021. In the context of these overall reforms, the resignation of the CBE governor in August was likely not voluntary but prompted by President Sisi. This is given the former’s reported opposition to certain IMF conditions, such as a more comprehensive liberalization of the Egyptian currency exchange rate against foreign currencies and privatization of the economy.

- FORECAST: Despite the IMF’s statement about the need for Egypt to make progress on fiscal and structural reforms, it is likely that it will grant Egypt’s application for the loan. Based on the IMF’s 2021 assessment of Egypt, the organization is seemingly satisfied with Egypt’s pace of reforms to become a more market-oriented economy and has praised Egypt for its fiscal discipline. The IMF is also likely to consider the shocks caused by the Russia-Ukraine conflict on the economy as an extenuating circumstance while granting the loan.

- In a bid to demonstrate fiscal prudence and reduce its subsidy burden, the government will likely accelerate the transition to targeted subsidy programs. Indications can already be seen in the government’s decision to revoke ration cards for 500,000 people on the grounds that they were drawing high monthly salaries and owned expensive vehicles. However, further subsidy reductions and cutbacks on social spending will likely intensify socio-economic strain, particularly on the poorer segments of society. FORECAST: While the government will likely state that subsidies will continue under a targeted program for the poorest, such cash transfer programs take time to be implemented due to bureaucratic obstacles. This may result in a sizeable proportion of the population remaining without assistance in the interim.

Government to make increased efforts to privatize public sector, seek Gulf investment

- Egypt has made efforts to privatize key state-owned enterprises (SOEs) to monetize assets and attract foreign investors. The Egyptian government expects to raise up to ten billion USD over four years. This move was also likely aimed to make Egypt more compliant with IMF conditions, which include efficiency changes to the underperforming public sector, and making Egypt more investor-friendly. The firms that have been listed include sectors such as fish farming, livestock, furniture, and fertilizer. This move may help mitigate Egypt’s expenditure on maintaining unprofitable SOEs and reduce future liabilities.

- FORECAST: However, given that the Egyptian government has announced privatization plans several times in the past without proper execution, it is possible that these measures may be delayed and not be implemented per the timeline. Additionally, the World Bank ranked Egypt 114 out of 190 countries in 2019 for “ease of doing business”. This is due to bureaucratic obstacles and corruption, which may deter private entities from investing in SOEs. Thus, despite the ambitious target, it is unlikely that the sale of state enterprises will yield sufficient revenue to pay off debts in the immediate future.

- FORECAST: The private sector is likely to underperform in the short-to-medium term as a result of inflation and the devaluation of the Egyptian pound, which has driven up the costs of inputs and imports, respectively. Combined with reduced demand within Egypt, this will likely adversely impact the sector, which may favor layoffs to mitigate diminished earnings.

- Meanwhile, since the onset of the Russia-Ukraine conflict, Egypt has received significant aid and investment from Gulf countries including Qatar, Saudi Arabia, and the UAE. This aid is likely motivated by the perception of Egypt as a stabilizing regional force and the necessity to prevent any unrest as a result of the deterioration of socio-economic conditions. That said, Gulf investments tend to be focused on firms that are already profitable, indicating that the investments are unlikely to be equitably spread across sectors of the Egyptian economy. FORECAST: These developments indicate that aid may be conditional, limited in nature, and unlikely to be a long-term solution to the structural challenges of the Egyptian economy. Furthermore, such investment may deepen Egypt’s dependence on Gulf intervention in the medium-to-long term.

Impact on Security Situation

Deterioration of socio-economic conditions unlikely to trigger widespread unrest, impact political stability

- While socio-economic grievances will likely increase the level of public dissatisfaction with the government, the probability of mass civil unrest remains low for several reasons. Protests have been effectively banned by the government since 2013, with the government cracking down on alleged violators. This includes the reported arrest of prominent political activists, which demonstrates the government’s resolve to minimize the mobilizing abilities of opposition groups. State censorship of cyberspace will likely also prevent any anti-government sentiment from being amplified or reflected in public spaces. These measures overall deter political mobilization against the government.

- The Egyptian government also faces no major organized political opposition. As a result, unpopular decisions are unlikely to be challenged. The largest opposition group, the Muslim Brotherhood-affiliated Freedom and Justice Party, has also lost its mobilizing capabilities due to frequent crackdowns by Egyptian authorities. It is thus unable to mobilize Egyptian citizens against the government. Similarly, while labor disputes are likely to increase over the coming months, they are likely to remain localized. The risk of accompanying civil unrest is low since Egypt does not have influential labor unions or civil society organizations which enjoy high mobilizing power.

- The government has also taken steps to contain grievances. For example, Egyptian authorities deferred a decision to hike electricity tariffs by six months in July, despite the added burden to the economy of 533 million USD. On September 1, the government also increased announced an increase from a monthly payment of 100 EGP to 300 EGP for nine million citizens for a six-month period and an increase in bread subsidies by 23 billion EGP to ensure food security. While these decisions exacerbate Egypt’s debt situation, this is also a means for the government to placate the public, thereby mitigating the risk of unrest. Similarly, the government has replaced political leadership to signal a commitment to improving governance. In August, President Sisi ordered a cabinet reshuffle, likely to project the government as accountable and sympathetic to citizens’ hardships.

- Nonetheless, some protests have been recorded in recent months. Most of these have been against specific firms over non-payment of wages and other labor disputes. Anti-government protests have largely been about the non-resolution of localized disputes. To that end, local authorities have been the target of the anger by residents rather than the national government. That said, the relative lack of visible protest activity does not indicate that anti-government sentiment is absent in the country. Many Egyptian citizens have taken to social media to express their dissatisfaction with the increasing socio-economic pressures and the role of government. Social media will remain a space for grievances despite the crackdown on protest activity by the government. While this may not be as disruptive as physical protests, it could potentially serve as a tool for mobilization, which increases the possibility of anti-government protests.

- FORECAST: Despite elevated socio-economic grievances and public frustration, the government is expected to remain politically stable. Authorities are likely to remain vigilant of any protest activity and will clamp down on any possible indications of protest, including on social media. Protest activity is likely to be more localized and targeted at local authorities, especially in the absence of any nationwide movement to oppose the government. The government may resort to censorship of media and the disruption of social networks to prevent popular mobilization. More frequent instances of labor action against companies are likely in the coming months, especially during periods of higher inflation. This is because workers are likely to demand higher wages to compensate for eroding purchasing power.

Recommendations

- Those operating or residing in Egypt are advised to remain cognizant of the overall elevated potential for protests and labor action resulting from rising inflation and socio-economic grievances.

- Refrain from posting any anti-government content on social media, including implied criticism of the government’s accountability for price hikes or food shortages. Egyptian authorities monitor cyberspace for online activity and may detain individuals, including foreign nationals, for perceived dissent.

- Remain cognizant of the potential for increased violent criminal activity and petty crime across Egypt as a result of deteriorating socio-economic conditions.