Americas Weekly Summary – June 12-18, 2024

Highlights of the Week

This report reviews notable events this week in the Americas. This includes the Argentine Senate narrowly approving the Omnibus reform bill; former president Morales accusing the Bolivian government of militarization after protests over fuel shortages; VP Marquez’ father and nephew surviving an armed attack in Valle del Cauca, Colombia; Honduras’ security measures to combat gang violence and reform the prison system; Mexican Peso’s (MXN) depreciation against the USD following Sheinbaum’s win in presidential elections; and a Peruvian commission passing a measure to enable mining concessions in Madre de Dios.

Argentina

Current Situation:

- On June 12, with 37-36 votes, the Senate narrowly approved President Javier Milei’s landmark “Omnibus” or “Law of Bases” reform bill, which would delegate powers to the executive regarding energy, pensions, and security; enact incentive schemes for foreign investors; and privatize key state-owned firms.

- On the same day, a large-scale demonstration denouncing the bill escalated into protestors throwing rocks at police and setting two vehicles ablaze. In response, security forces deployed water cannons and pepper spray and arrested 29 protestors.

Assessments & Forecast: The bill’s approval, despite the reduction of its articles from 600 to 238, is significant given that it is the first to be approved in both houses of Congress under Milei, representing a major step forward for Milei’s reform agenda. Although the bill’s modified version is pending approval in Senate before being sent back to the Chamber of Deputies for ratification, upward movement in stock and government bonds markets following the vote reflect investors’ anticipation of improvements in Argentina’s economy amid a 300 percent inflation and large government debts. This is supported by Argentina’s stock market index rising by 7.4 percent on June 13. Meanwhile, given concerns that some of the reforms would negatively impact welfare schemes and pensions, intermittent medium-to-large scale protests and strikes by left-wing political factions and trade unions remain likely in the near-to-medium term, carrying a medium risk of escalation as seen on June 12. The potential for these protests is particularly high during the bill’s subsequent proceedings over the coming weeks at Congreso in Buenos Aires.

Bolivia

Current Situation:

- On June 16, former President Evo Morales accused President Luis Arce of alleged militarization of the country through “Plan Boqueron”.

- This comes after the government deployed 880 soldiers at 120 fuel stations nationwide to combat fuel smuggling amid gasoline shortages as of June 12. Defense Minister Edmundo Novillo rejected the veracity of Morales’ alleged plan.

- A group of transport unions, who planned indefinite road blockades from June 17 to denounce lack of fuel and dollar liquidity, rescinded the move after meeting Arce, stating they will remain “in emergency”.

Assessments & Forecast: Morales’ accusation of militarization indicates an attempt to mount the already elevated political and transport union-led pressure against the Arce-led government over persisting fuel shortages and low currency reserves. This comes after several protests over the issue in recent weeks, including blockades by truckers in multiple departments from June 3-5 and a merchant-led march from Patacamaya to La Paz from June 11-17. Thus, political polarization within the Movimiento al Socialismo (MAS) will heighten, particularly ahead of Morales’ July 10 party congress and the 2025 Presidential elections. This is especially following Morales’ June 10 speech, asserting his candidacy for the 2025 presidential elections. To this end, Morales may attempt to increasingly capitalize on existing shortages as well as the prolonged delay in appointing new Tribunal Constitucional Plurinacional (TCP) magistrates. This will increase the potential for Evistas-led (pro-Morales MAS faction) blockades in the coming weeks, akin to the large-scale protests in January-February, which exacerbated fuel shortages.

Colombia

Current Situation:

- On June 16, unidentified suspects fired shots at the vehicle in which VP Francia Marquez’ father and nephew were travelling in Jamundi, Valle del Cauca.

- Estado Mayor Central Fuerzas Armadas Revolucionarias de Colombia (EMC-FARC) members fired shots outside a police station in Cajibio, Cauca on June 13.

- In Suarez, Cauca, suspects opened fire at a police station on June 12. An EMC-FARC-led explosive attack was reported near a police patrol in Jamundi on June 12.

Assessments & Forecast: The June 16 incident’s modus operandi suggests it was targeted and possibly orchestrated to intimidate Marquez, especially as it coincided with Father’s Day. To this end, the attack may have been perpetrated by EMC-FARC in response to continued military operations against the group in southwestern departments, especially Cauca and Valle del Cauca, and derailed prospects of peace talks after its leader Ivan Mordisco withdrew from the dialogue on April 16. This is possible because of a combination of factors and precedent, including the VP’s advocacy for Paz Total, previous threats for her work as an environmental activist, and an alleged assassination attempt with the discovery of explosives near her family residence in Suarez in January 2023 after the peace process began in December 2022. Further, recurring EMC-FARC-led attacks in Cauca and Valle del Cauca underscore the ineffectiveness of military reinforcements, with security units likely to remain primary targets of gunfire and medium-to-high intensity explosives. Moreover, the threat to social and political activists in Cauca and Valle del Cauca will remain high amid escalating hostilities with EMC-FARC.

Honduras

Current Situation:

- On June 14, President Xiomara Castro announced new security measures as part of a broader strategy to combat gang violence and reform the prison system.

- The measures include enhancing the military’s role in fighting organized crime, major security operations, and the construction of a “mega-prison” to alleviate overcrowding.

- Additionally, Castro called for a penal reform to classify gang members as terrorists and subject them to collective trials.

Assessments & Forecast: This initiative reflects Honduras’ commitment to adopting hardline approaches to combat organized crime, echoing similar measures implemented in other countries in the region, namely El Salvador and Ecuador. Castro’s strategy aims to tackle the increased violence linked to drug trafficking and related criminality, likely exacerbated by the country’s strategic location in Central America. Honduras borders the Pacific Ocean to the west and the Caribbean Sea to the north, making it a prime transit point for drugs originating from South America. The associated violence seen in recent months has prompted a May 15 report from the Comision Interamericana de Derechos Humanos (CIDH) to identify Honduras as the “most unsafe” country in Central America. With the security measures calling for immediate interventions in the departments with the highest incidence of criminality and associated violence, large-scale security deployments can be anticipated in the northeastern departments of Colon, Gracias a Dios, and Olancho. Moreover, law enforcement authorities are expected to ramp up the number of targeted operations in criminal group’s strongholds, including in the cities of La Ceiba, San Pedro Sula, and Tegucigalpa.

Mexico

Current Situation:

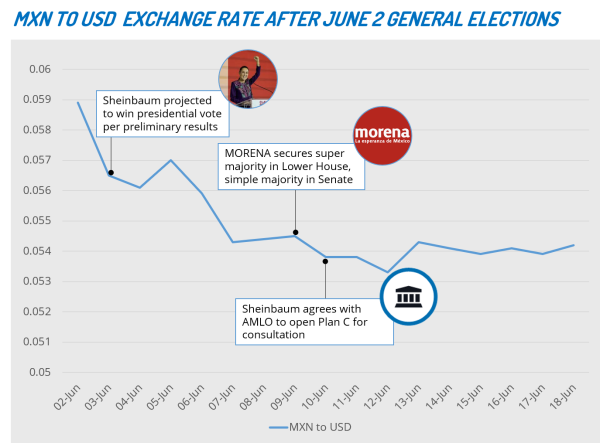

- The Mexican Peso (MXN) continued to depreciate by 0.81 percent against the USD on June 17, accounting for an estimated 11 percent decline following the election results decreeing Movimiento Regeneracion Nacional’s (MORENA) Claudia Sheinbaum as the next president.

- It is considered the deepest depreciation in MXN’s value since the COVID-19 pandemic.

Assessments & Forecast: This development highlights the current volatility among foreign investors amid concerns over Sheinbaum’s June 10 endorsement of ‘Plan C’ constitutional reforms, such as electing judges by popular vote and removing autonomous regulatory bodies acting as a check on the executive among other measures, proposed by outgoing President Andres Manuel Lopez Obrador (AMLO) in February. The risk aversion by investors is driven by concerns of potential institutional erosion and greater government intervention in the economy, which are not perceived as market-friendly. Such concerns are further exacerbated by the formation of a qualified majority by the MORENA-led Seguimos Haciendo Historia coalition in the Chamber of Deputies, predicted to win 372 of 500 seats, and 83 of 128 seats in the Senate, enabling the incoming administration to pass legislation, including constitutional reforms, without significant opposition. This, however, contrasts with Sheinbaum’s pursuit to further nearshore industrial production and supply chains to Mexico, having already surpassed China as the largest exporter of goods by value to the USA in 2023. Furthermore, investors’ confidence in Mexico will likely be influenced by the outcomes of the US presidential elections in November, with the next administration party to review the continuity of the United States-Mexico-Canada Agreement (USMCA) on July 1, 2026.

Peru

Current Situation

- Per June 16 reports, Comision de Energia y Minas del Congreso de la Republica, a Congressional Commission for the energy and mining industry, passed a rule that would allow mining concessions in artisanal and small-scale mining areas in Madre de Dios.

Assessments & Forecast: The passing of the measure reflects an attempt by the government to bring ongoing illegal mining, primarily of gold, under governmental tax, social and environmental regulations. However, the measure is likely to exacerbate environmental concerns by expanding the permissible territory for mining activity in the department. Reports indicating that out of the 11,023 entities registered officially for mining formalization, 84 percent of them do not have the necessary requirements for carrying out the activity within environmental standards, adds credence to the concerns. Moreover, the Amazonian department has reportedly lost 18,421 hectares of forest due to illegal alluvial mining. Thus, although the measure, if passed, may possibly mitigate the use of illegal mining to fund organized crime, it is liable to face regulatory scrutiny and delays, especially with the decision lacking Ministerio del Ambiente’s (MINAM, Environment Ministry) approval. Thus, amid significant gaps in the existing mechanisms to curb illegal mining, the government will likely continue to resort to stopgap security measures such as the 60-day State of Emergency imposed in six districts of Madre de Dios in April. Consequently, illegal mining will continue to be a major source of funding for organized crime groups active in the area, including groups linked to the Brazilian transnational organization, Comando Vermelho.

Other Developments

- The International Monetary Fund on June 13 announced the approval of financial aid worth 800 million USD of the broader 44 billion USD financial program to drive economic recovery in Argentina.

- Chilean Finance Minister Mario Marcel stated on June 18 that more than 50 companies have shown interest in developing lithium projects in the country after the government began accepting proposals on April 15.

- Persisting heavy rains and subsequent flooding have been recorded in parts of Central America since June 14, including in Ecuador, El Salvador, Guatemala, Honduras, southern Mexico, and Panama.

- Ecuador’s Corte Constitucional on June 14 invalidated the 60-day State of Emergency (SoE) declared by President Daniel Noboa on May 22 in seven coastal provinces to combat organized crime.

- The Ecuadorian Foreign Ministry announced on June 16 that Mexico and Ecuador will maintain mirror agreements, with Switzerland acting as a diplomatic conduit and offering consular support for Ecuador in Mexico.

- Nicaragua’s Ministry of Energy and Mines canceled four mining concessions to different companies due to alleged inactivity by concessionaires operating in the Chinandega, Jinotega, Leon, Madriz, and Nueva Segovia departments, per June 13 reports.

- A US Navy nuclear-powered submarine arrived in Guantanamo Bay on June 13, following the arrival of four Russian naval vessels, including a nuclear-powered submarine and a frigate, in Havana, Cuba on June 12.

- In New York City, NY, USA, suspects wearing masks vandalized the homes of four executives associated with the Brooklyn Museum, including its Jewish Director, on June 13.

The Week Ahead

- June 19: Staggered two-hour strikes by subway workers in Buenos Aires, Argentina

- June 19: Strike, protest by education workers in Rio de Janeiro, Brazil

- June 19: Nationwide strike, protests by unionized teachers in Bogota, Colombia

- June 19: Labor Day in Trinidad & Tobago

- June 19: Artigas’ Birthday in Uruguay

- June 20: National Flag Day in Argentina

- June 20-21: Strike, protest by education union in Sao Paulo state, Brazil

- June 20: Indigenous Peoples Day in Chile

- June 20: Student-led protest denouncing “American imperialism” in Santiago, Concepcion, Chile

- June 20–July 14: 48th Copa America in the USA

- June 21: Andean New Year Holiday in Bolivia

- June 21-23: Pro-life events, rally in Washington, DC, USA

- June 23: Pride parade in Bogota, Colombia

- June 23: Pride parade in San Juan, Puerto Rico

- June 24: Pro-choice protests in Canada

- June 24: Itni Raymi Holiday in Peru

- June 25: Democratic and Republican primaries in Colorado, New York, Utah, USA

Highlights of the Week

This report reviews notable events this week in the Americas. This includes the Argentine Senate narrowly approving the Omnibus reform bill; former president Morales accusing the Bolivian government of militarization after protests over fuel shortages; VP Marquez’ father and nephew surviving an armed attack in Valle del Cauca, Colombia; Honduras’ security measures to combat gang violence and reform the prison system; Mexican Peso’s (MXN) depreciation against the USD following Sheinbaum’s win in presidential elections; and a Peruvian commission passing a measure to enable mining concessions in Madre de Dios.

Argentina

Current Situation:

- On June 12, with 37-36 votes, the Senate narrowly approved President Javier Milei’s landmark “Omnibus” or “Law of Bases” reform bill, which would delegate powers to the executive regarding energy, pensions, and security; enact incentive schemes for foreign investors; and privatize key state-owned firms.

- On the same day, a large-scale demonstration denouncing the bill escalated into protestors throwing rocks at police and setting two vehicles ablaze. In response, security forces deployed water cannons and pepper spray and arrested 29 protestors.

Assessments & Forecast: The bill’s approval, despite the reduction of its articles from 600 to 238, is significant given that it is the first to be approved in both houses of Congress under Milei, representing a major step forward for Milei’s reform agenda. Although the bill’s modified version is pending approval in Senate before being sent back to the Chamber of Deputies for ratification, upward movement in stock and government bonds markets following the vote reflect investors’ anticipation of improvements in Argentina’s economy amid a 300 percent inflation and large government debts. This is supported by Argentina’s stock market index rising by 7.4 percent on June 13. Meanwhile, given concerns that some of the reforms would negatively impact welfare schemes and pensions, intermittent medium-to-large scale protests and strikes by left-wing political factions and trade unions remain likely in the near-to-medium term, carrying a medium risk of escalation as seen on June 12. The potential for these protests is particularly high during the bill’s subsequent proceedings over the coming weeks at Congreso in Buenos Aires.

Bolivia

Current Situation:

- On June 16, former President Evo Morales accused President Luis Arce of alleged militarization of the country through “Plan Boqueron”.

- This comes after the government deployed 880 soldiers at 120 fuel stations nationwide to combat fuel smuggling amid gasoline shortages as of June 12. Defense Minister Edmundo Novillo rejected the veracity of Morales’ alleged plan.

- A group of transport unions, who planned indefinite road blockades from June 17 to denounce lack of fuel and dollar liquidity, rescinded the move after meeting Arce, stating they will remain “in emergency”.

Assessments & Forecast: Morales’ accusation of militarization indicates an attempt to mount the already elevated political and transport union-led pressure against the Arce-led government over persisting fuel shortages and low currency reserves. This comes after several protests over the issue in recent weeks, including blockades by truckers in multiple departments from June 3-5 and a merchant-led march from Patacamaya to La Paz from June 11-17. Thus, political polarization within the Movimiento al Socialismo (MAS) will heighten, particularly ahead of Morales’ July 10 party congress and the 2025 Presidential elections. This is especially following Morales’ June 10 speech, asserting his candidacy for the 2025 presidential elections. To this end, Morales may attempt to increasingly capitalize on existing shortages as well as the prolonged delay in appointing new Tribunal Constitucional Plurinacional (TCP) magistrates. This will increase the potential for Evistas-led (pro-Morales MAS faction) blockades in the coming weeks, akin to the large-scale protests in January-February, which exacerbated fuel shortages.

Colombia

Current Situation:

- On June 16, unidentified suspects fired shots at the vehicle in which VP Francia Marquez’ father and nephew were travelling in Jamundi, Valle del Cauca.

- Estado Mayor Central Fuerzas Armadas Revolucionarias de Colombia (EMC-FARC) members fired shots outside a police station in Cajibio, Cauca on June 13.

- In Suarez, Cauca, suspects opened fire at a police station on June 12. An EMC-FARC-led explosive attack was reported near a police patrol in Jamundi on June 12.

Assessments & Forecast: The June 16 incident’s modus operandi suggests it was targeted and possibly orchestrated to intimidate Marquez, especially as it coincided with Father’s Day. To this end, the attack may have been perpetrated by EMC-FARC in response to continued military operations against the group in southwestern departments, especially Cauca and Valle del Cauca, and derailed prospects of peace talks after its leader Ivan Mordisco withdrew from the dialogue on April 16. This is possible because of a combination of factors and precedent, including the VP’s advocacy for Paz Total, previous threats for her work as an environmental activist, and an alleged assassination attempt with the discovery of explosives near her family residence in Suarez in January 2023 after the peace process began in December 2022. Further, recurring EMC-FARC-led attacks in Cauca and Valle del Cauca underscore the ineffectiveness of military reinforcements, with security units likely to remain primary targets of gunfire and medium-to-high intensity explosives. Moreover, the threat to social and political activists in Cauca and Valle del Cauca will remain high amid escalating hostilities with EMC-FARC.

Honduras

Current Situation:

- On June 14, President Xiomara Castro announced new security measures as part of a broader strategy to combat gang violence and reform the prison system.

- The measures include enhancing the military’s role in fighting organized crime, major security operations, and the construction of a “mega-prison” to alleviate overcrowding.

- Additionally, Castro called for a penal reform to classify gang members as terrorists and subject them to collective trials.

Assessments & Forecast: This initiative reflects Honduras’ commitment to adopting hardline approaches to combat organized crime, echoing similar measures implemented in other countries in the region, namely El Salvador and Ecuador. Castro’s strategy aims to tackle the increased violence linked to drug trafficking and related criminality, likely exacerbated by the country’s strategic location in Central America. Honduras borders the Pacific Ocean to the west and the Caribbean Sea to the north, making it a prime transit point for drugs originating from South America. The associated violence seen in recent months has prompted a May 15 report from the Comision Interamericana de Derechos Humanos (CIDH) to identify Honduras as the “most unsafe” country in Central America. With the security measures calling for immediate interventions in the departments with the highest incidence of criminality and associated violence, large-scale security deployments can be anticipated in the northeastern departments of Colon, Gracias a Dios, and Olancho. Moreover, law enforcement authorities are expected to ramp up the number of targeted operations in criminal group’s strongholds, including in the cities of La Ceiba, San Pedro Sula, and Tegucigalpa.

Mexico

Current Situation:

- The Mexican Peso (MXN) continued to depreciate by 0.81 percent against the USD on June 17, accounting for an estimated 11 percent decline following the election results decreeing Movimiento Regeneracion Nacional’s (MORENA) Claudia Sheinbaum as the next president.

- It is considered the deepest depreciation in MXN’s value since the COVID-19 pandemic.

Assessments & Forecast: This development highlights the current volatility among foreign investors amid concerns over Sheinbaum’s June 10 endorsement of ‘Plan C’ constitutional reforms, such as electing judges by popular vote and removing autonomous regulatory bodies acting as a check on the executive among other measures, proposed by outgoing President Andres Manuel Lopez Obrador (AMLO) in February. The risk aversion by investors is driven by concerns of potential institutional erosion and greater government intervention in the economy, which are not perceived as market-friendly. Such concerns are further exacerbated by the formation of a qualified majority by the MORENA-led Seguimos Haciendo Historia coalition in the Chamber of Deputies, predicted to win 372 of 500 seats, and 83 of 128 seats in the Senate, enabling the incoming administration to pass legislation, including constitutional reforms, without significant opposition. This, however, contrasts with Sheinbaum’s pursuit to further nearshore industrial production and supply chains to Mexico, having already surpassed China as the largest exporter of goods by value to the USA in 2023. Furthermore, investors’ confidence in Mexico will likely be influenced by the outcomes of the US presidential elections in November, with the next administration party to review the continuity of the United States-Mexico-Canada Agreement (USMCA) on July 1, 2026.

Peru

Current Situation

- Per June 16 reports, Comision de Energia y Minas del Congreso de la Republica, a Congressional Commission for the energy and mining industry, passed a rule that would allow mining concessions in artisanal and small-scale mining areas in Madre de Dios.

Assessments & Forecast: The passing of the measure reflects an attempt by the government to bring ongoing illegal mining, primarily of gold, under governmental tax, social and environmental regulations. However, the measure is likely to exacerbate environmental concerns by expanding the permissible territory for mining activity in the department. Reports indicating that out of the 11,023 entities registered officially for mining formalization, 84 percent of them do not have the necessary requirements for carrying out the activity within environmental standards, adds credence to the concerns. Moreover, the Amazonian department has reportedly lost 18,421 hectares of forest due to illegal alluvial mining. Thus, although the measure, if passed, may possibly mitigate the use of illegal mining to fund organized crime, it is liable to face regulatory scrutiny and delays, especially with the decision lacking Ministerio del Ambiente’s (MINAM, Environment Ministry) approval. Thus, amid significant gaps in the existing mechanisms to curb illegal mining, the government will likely continue to resort to stopgap security measures such as the 60-day State of Emergency imposed in six districts of Madre de Dios in April. Consequently, illegal mining will continue to be a major source of funding for organized crime groups active in the area, including groups linked to the Brazilian transnational organization, Comando Vermelho.

Other Developments

- The International Monetary Fund on June 13 announced the approval of financial aid worth 800 million USD of the broader 44 billion USD financial program to drive economic recovery in Argentina.

- Chilean Finance Minister Mario Marcel stated on June 18 that more than 50 companies have shown interest in developing lithium projects in the country after the government began accepting proposals on April 15.

- Persisting heavy rains and subsequent flooding have been recorded in parts of Central America since June 14, including in Ecuador, El Salvador, Guatemala, Honduras, southern Mexico, and Panama.

- Ecuador’s Corte Constitucional on June 14 invalidated the 60-day State of Emergency (SoE) declared by President Daniel Noboa on May 22 in seven coastal provinces to combat organized crime.

- The Ecuadorian Foreign Ministry announced on June 16 that Mexico and Ecuador will maintain mirror agreements, with Switzerland acting as a diplomatic conduit and offering consular support for Ecuador in Mexico.

- Nicaragua’s Ministry of Energy and Mines canceled four mining concessions to different companies due to alleged inactivity by concessionaires operating in the Chinandega, Jinotega, Leon, Madriz, and Nueva Segovia departments, per June 13 reports.

- A US Navy nuclear-powered submarine arrived in Guantanamo Bay on June 13, following the arrival of four Russian naval vessels, including a nuclear-powered submarine and a frigate, in Havana, Cuba on June 12.

- In New York City, NY, USA, suspects wearing masks vandalized the homes of four executives associated with the Brooklyn Museum, including its Jewish Director, on June 13.

The Week Ahead

- June 19: Staggered two-hour strikes by subway workers in Buenos Aires, Argentina

- June 19: Strike, protest by education workers in Rio de Janeiro, Brazil

- June 19: Nationwide strike, protests by unionized teachers in Bogota, Colombia

- June 19: Labor Day in Trinidad & Tobago

- June 19: Artigas’ Birthday in Uruguay

- June 20: National Flag Day in Argentina

- June 20-21: Strike, protest by education union in Sao Paulo state, Brazil

- June 20: Indigenous Peoples Day in Chile

- June 20: Student-led protest denouncing “American imperialism” in Santiago, Concepcion, Chile

- June 20–July 14: 48th Copa America in the USA

- June 21: Andean New Year Holiday in Bolivia

- June 21-23: Pro-life events, rally in Washington, DC, USA

- June 23: Pride parade in Bogota, Colombia

- June 23: Pride parade in San Juan, Puerto Rico

- June 24: Pro-choice protests in Canada

- June 24: Itni Raymi Holiday in Peru

- June 25: Democratic and Republican primaries in Colorado, New York, Utah, USA