Global Analysis: Houthis successfully conduct maritime attacks despite countermeasures by international coalitions; threat to merchant ships to persist

Executive Summary

- In the first months of 2024, the Houthis continued targeting commercial ships around Yemen despite the months-long deployment of Western-led maritime forces.

- Within this period, they shifted from targeting the Red Sea toward more attacks in the Gulf of Aden, proved to be able to precisely hit ships and cause casualties, pivoted to target more US and UK-owned vessels, and threatened to extend attacks to the Indian Ocean.

- This highlights the continued Houthi threat in maritime zones surrounding Yemen, which will continue to adversely impact global shipping and supply chains.

- The Houthis have thus far refrained from directly attacking Gulf states. This indicates that they are unwilling to involve Gulf countries in the current maritime hostilities amid their effort to isolate Israel, the US, and the UK.

- Businesses worldwide are advised to allot for further supply chain disruptions and cost increases due to continued Houthi attacks at sea.

Current Situation

- The Yemen-based Houthis have repeatedly targeted commercial vessels traversing the Red Sea and Gulf of Aden since November 19. The group claims its actions constitute support for the Palestinians that will continue as long as the Israel-Hamas conflict persists.

- On December 19, the US launched Operation Prosperity Guardian (OPG), involving multiple states. It is the primary multinational security deployment aimed at countering the Houthi threat.

- On February 19, the EU launched its own naval initiative to protect shipping routes in the region, named EUNAVFOR Operation ASPIDES.

- In addition to the multinational defensive maritime initiatives, since January 12, the US and UK have conducted multiple rounds of strikes targeting Yemeni territory aimed at degrading Houthi capabilities.

- On February 18, the Houthis successfully targeted “Rubymar,” a UK-owned merchant vessel, with an anti-ship ballistic missile (ASBM) in the Gulf of Aden. This was the first instance since the start of the Houthi campaign in which a ship was rendered completely dysfunctional and abandoned by its crew. It eventually sank on March 2.

- On March 5, the Houthis successfully targeted the Liberian-owned ship True Confidence in the Gulf of Aden, killing three foreign crew members. This marked the first instance since the beginning of the Houthi campaign in which fatalities were recorded among seafarers.

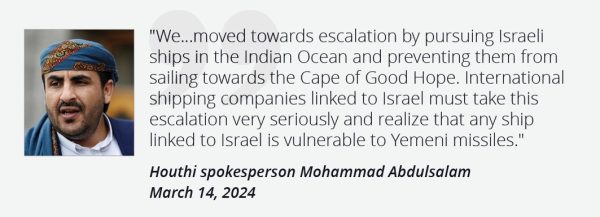

- On March 12, the Houthi Military Spokesperson, Yahya Saree, pledged to escalate the movement’s attacks during the month of Ramadan.

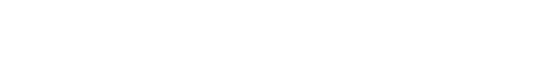

- On March 14, the Houthi movement pledged to escalate their attacks and pursue “Israeli-linked” vessels in the Indian Ocean.

- On March 18, the US Department of Transportation’s (DOT’s) Maritime Administration advised US-flagged vessels to turn off their Automatic Identification System (AIS) transponders when transiting the Southern Red Sea, Bab al-Mandab Strait, and the Gulf of Aden.

Shipping-related developments

- In February, the International Transport Workers Federation (ITF), a major seafarer rights union, announced the expansion of the International Bargaining Group’s (IBF) High-Risk Areas to encompass the Gulf of Aden and adjacent waters. The IBF is a forum that brings together the ITF and international maritime employers. The change granted seafarers the right to refuse sailing into the area and strengthened repatriation and compensation mechanisms for seafarers.

- In March, major shipping companies, including Maersk and Hapag-Lloyd, reaffirmed their decisions to suspend shipping through the Red Sea and reroute shipments through South Africa’s Cape of Good Hope.

- According to an International Monetary Fund (IMF) statement from March 7, in the first two months of 2024, trade volume passing through the Suez Canal decreased by 50 percent. Meanwhile, trade transiting around the Cape of Good Hope surged by 74 percent year-on-year.

- On March 2, the US State Department stated that the Houthi attacks on commercial shipping in the Red Sea are doubling shipping costs to the US and increasing food, medicine, and fuel prices.

Assessments & Forecast

Houthis project escalation, continue threatening vessels despite Western-led security umbrellas

- The Houthis continued to launch attacks against commercial vessels despite the US-led OPG that has been ongoing since December 18, the more recent deployment of the EU-led operation, and the multiple rounds of US and UK airstrikes against Houthi infrastructures within Yemeni. This, together with the latest shipping-related developments (outlined above), highlights the continued knock-on effects the Houthi campaign has on global shipping and the limitations of Western-led efforts to ensure security along the major shipping route. This was highlighted in the US DOT’s March 18 recommendations to US-flagged vessels to take special precautions when traversing the maritime route. It is also highlighted by the continued reluctance of major shipping firms to resume travel in the waterway.

- This reluctance likely partly emanates from the understanding that amid persistent Houthi aerial attacks, vessels’ security cannot be guaranteed by conventional measures that firms can take themselves. Instead, they are predicated on an international-level military or political solution that has yet to materialize. These perceptions also affect international seafarers’ labor unions, who are increasingly concerned about the situation and exert further pressures on shipping firms, as highlighted in the ITF-related developments.

Recent attacks highlight Houthi capabilities to strike targets at sea

The Houthi attacks against the UK-owned Rubymar and Liberia-owned True Confidence were particularly notable. The attack on Rubymar not only constituted the first attack following which a ship sank, but it also turned the vessel into a regional environmental hazard given that it was carrying ammonium phosphate sulfate fertilizer that may spill. The attack on True Confidence constitutes the first instance in which the Houthis caused fatalities in an attack. Picture material depicting the incident shows that the attack impacted the vessel’s Bridge, the area from where the captain and crew navigate the ship. Both Rubymar and True Confidence were targeted with Houthi anti-ship ballistic missiles (ASBMs) in the Gulf of Aden. This highlights the Houthis’ ability to not only conduct precision ASBM strikes but also conduct them in the Gulf of Aden. This highlights that they can launch successful missile attacks beyond their immediate backyard of the Red Sea and its coastal areas that they control.

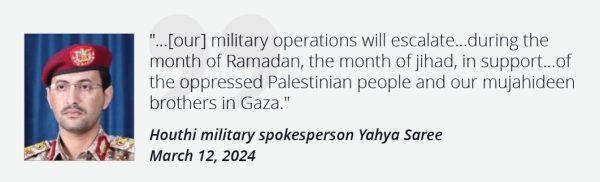

Houthis shift to conduct more attacks in Gulf of Aden compared to Red Sea

The abovementioned attacks also correspond to a broader trend since mid-January, in which the Houthis are increasingly targeting the Gulf of Aden, diverging from their previous focus on the Red Sea during November-December 2023. It is plausible that the Houthis made this decision due to the countermeasures introduced by the US- and EU-led security operations. By expanding the geographical scope of their attacks, the Houthis likely wish to stretch these coalitions’ assets across Yemen’s surrounding waters, thus rendering their ability to intercept Houthi aerial attacks less effective. It also allows the Iran-backed movement to project prowess vis-a-vis the West. This desire would also strengthen the Houthi motivation to at least try to launch attacks beyond the confines of the Gulf of Aden, further into the Arabian Sea.

Houthis’ use of water-borne attack platforms

- Another way the Houthis seek to challenge the Western-led maritime operations is by using water-borne attack platforms. This was highlighted in several instances since February in which US Navy forces announced they intercepted Houthi unmanned surface vessels (USVs) (remote-controlled explosive-laden fast boats) and [explosive-laden] unmanned underwater vessels (UUVs). The use of UUVs has not been well documented in the arena thus far, and the Houthi movement has yet to introduce or claim them on official channels. This renders the US announcements notable, highlighting that the Houthis continue developing their arsenal of water-borne attack platforms.

- Unlike air-borne arms, water-borne devices require the Houthis to launch them from their coastal areas of control. Thus, they will likely pose a more viable threat in and around the Red Sea. Regardless, it still compounds the challenges facing the international coalitions in their efforts to closely monitor the maritime arena around Yemen and underscore the risks posed to commercial vessels in the Red Sea.

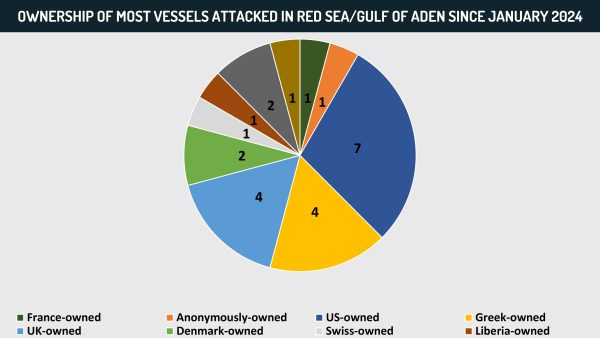

Houthis’ greater emphasis on attacks against US, UK-owned vessels

- The Houthis’ initial focus (November-December) was to claim attacks on ships purportedly associated with Israel and ones that are bound for Israel. However, in light of the US and UK’s strikes in Yemen, this has been extended to US and UK-linked ships. This was highlighted in numerous statements by Houthi leaders, the attack against Rubymar (a UK-owned vessel), and at least one instance in which the Houthis attempted to target a US-owned, flagged, and operated vessel in February. The Houthis’ pursuit of UK and US-owned vessels is also underscored in the characteristics of firms owning ships that were attacked thus far in 2024, of which around 46 percent are registered in the US and UK.

- This shows that the repeated US-UK-led strikes against Houthi assets in Yemen not only failed to deter the Houthis from engaging in attacks but also prompted them to try to exact a price from US and UK-linked shipping firms. It highlights the Houthis’ audacity vis-a-vis the West, which is also highlighted in their current threats to expand their attacks into maritime zones in the Indian Ocean. With all of the above, the Houthis project a qualitative escalation in their campaign to target commercial vessels, which will partly be compounded by the religious fervor and symbolism associated with the current period of Ramadan (until April 9).

Possible Houthi intelligence gaps, risks of misidentification of vessels

- Regardless of the Houthi discourse and focus on Israeli, American, and British ships, many other foreign firms, as well as crewmembers of diverse origins, are impacted by the Houthi attacks. There were also instances that pointed to misidentification by the Houthis in recent months, which can likely be partially attributed to the complex and dynamic nature of ownership in the maritime shipping industry. For instance, in January, the Houthis targeted a vessel with opaque ownership that may have been transporting Russian oil. The ship was reportedly sold by a UK-based firm several months before the attack. Its previous British ownership appears to have been the only reason the Houthis would decide to attack it. Similarly, True Confidence, which the Houthis designated as “American,” reportedly only belonged to a US firm in the past. In February, the Houthis targeted another alleged “American” ship, Star Iris. It was a Greek-owned vessel reportedly transporting grain to Iran, the Houthis’ primary backer.

- All of the above point to risks of misidentification and miscalculations in the Houthi effort to choose targets at sea, which can result from poor or outdated intelligence. This further compounds the threat posed to international shipping firms as a whole.

Forecast

- The Houthis will likely launch additional maritime attacks in the short-to-medium term despite the bolstered international efforts to offset the threat. This will continue to impact global shipping firms, which will continue to be reluctant to resume operations through the Gulf of Aden/Red Sea. This will increase delays and shipment costs due to issues such as length of journey, security, insurance, and seafarers’ demands for compensation associated with increased risks. This is liable to be compounded by the threat of piracy off the coast of Somalia, which was recently highlighted on March 12.

- The prolongation of the Houthi campaign will thus likely continue to impact global supply chains, compounding prices of goods and inflationary pressures. This will be bolstered by additional challenges in major maritime chokepoints, such as disruptions to trade in the Panama Canal prompted by drought and infrastructural limitations in ports throughout Africa.

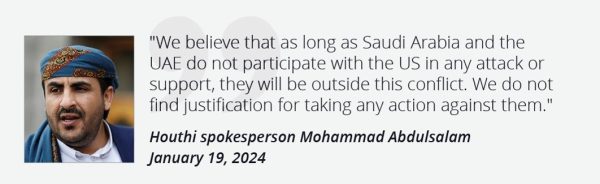

Houthis unlikely to extend hostilities to Gulf states

- The period before the launching of the US-led OPG in December was characterized by uncertainty regarding the potential for escalation that would involve Houthi attacks against their regional foes:– Saudi Arabia, the UAE, and Bahrain. The Houthis threatened and attempted to deter these states from associating themselves with the US-led operation. Riyadh and Abu Dhabi indeed kept a low profile and did not extend support to the US-led initiative, at least publicly. This highlights both states’ reluctance to provoke the Houthis and safeguard their primary interest vis-a-vis the Iran-backed movement– namely, to preserve calm and strive to extend the Yemen ceasefire.

- Bahrain is at a comparatively greater risk of retaliatory attacks by the Houthis. This is because, unlike Riyadh and Abu Dhabi, Manama has officially and publicly associated itself with the US-led OPG. Bahrain also facilitates US and UK airstrikes in Yemen, as indicated by public statements from US CENTCOM. Consequently, Bahrain faces a comparatively higher risk of prompting Houthi attacks against it as a price tag for explicitly siding with the US against them.

- That said, the Houthis did not extend hostilities to aerial attacks against Gulf states, including Bahrain. This is despite the launching of the US-led maritime coalition and numerous US- and UK-led airstrikes in Yemen over the past months. This suggests that the Houthis currently retain an interest in not provoking these states and do not seek to exact a price from them for US-led action. This is likely reflective of the Houthi goal of isolating Israel, the US, and the UK and challenging their Middle East policies without embroiling other regional actors. Furthermore, the Houthis also expressed their interest in advancing UN-mediated negotiations to extend the Yemen truce, as highlighted in recent UN statements. This highlights that the Houthis still share a desire for calm within the context of the Yemen civil war, further motivating the Houthis not to escalate hostilities with the Saudi-led camp. Recent remarks by Houthi officials further corroborate this desire for de-confliction. FORECAST: Thus, the Houthis are unlikely to extend their campaign to encompass aerial attacks against Gulf states at the current juncture.

Recommendations

- Businesses and consumers worldwide are advised to allot for further supply chain disruptions and cost increases due to continued Houthi attacks in and around the Red Sea and Gulf of Aden.

- Monitor regional events related to the Israel-Hamas conflict, given their corresponding link to the Houthi campaign at sea.

- Those traveling in and around Middle Eastern maritime zones, including in the Indian Ocean, should remain apprised of UKMTO and US DOT Maritime Administration-issued notices, as well as being aware of NATO Shipping Center alerts.

- As per US DOT recommendations, US-flagged commercial vessels are advised to coordinate voyage planning with US Naval Forces Central Command (NAVCENT) Naval Cooperation and Guidance for Shipping (NCAGS) and consider their specific recommendations and guidance.

- For essential Red Sea travel, review ships’ ownership and management history for past links to the US, UK, and Israel.

- Remain vigilant for suspicious objects, actors, and possible threats at sea.

- Ensure crewmembers’ security awareness, contingency plans, and ability to respond to incidents at sea.

- Owners and operators of vessels potentially involved in legal cases relating to the US sanctions regimes on Iran are advised to conduct risk assessments before traveling near Iranian waters, given the risk of detention by Iranian authorities.

- For any questions and/or risk assessments, contact us at [email protected].

Executive Summary

- In the first months of 2024, the Houthis continued targeting commercial ships around Yemen despite the months-long deployment of Western-led maritime forces.

- Within this period, they shifted from targeting the Red Sea toward more attacks in the Gulf of Aden, proved to be able to precisely hit ships and cause casualties, pivoted to target more US and UK-owned vessels, and threatened to extend attacks to the Indian Ocean.

- This highlights the continued Houthi threat in maritime zones surrounding Yemen, which will continue to adversely impact global shipping and supply chains.

- The Houthis have thus far refrained from directly attacking Gulf states. This indicates that they are unwilling to involve Gulf countries in the current maritime hostilities amid their effort to isolate Israel, the US, and the UK.

- Businesses worldwide are advised to allot for further supply chain disruptions and cost increases due to continued Houthi attacks at sea.

Current Situation

- The Yemen-based Houthis have repeatedly targeted commercial vessels traversing the Red Sea and Gulf of Aden since November 19. The group claims its actions constitute support for the Palestinians that will continue as long as the Israel-Hamas conflict persists.

- On December 19, the US launched Operation Prosperity Guardian (OPG), involving multiple states. It is the primary multinational security deployment aimed at countering the Houthi threat.

- On February 19, the EU launched its own naval initiative to protect shipping routes in the region, named EUNAVFOR Operation ASPIDES.

- In addition to the multinational defensive maritime initiatives, since January 12, the US and UK have conducted multiple rounds of strikes targeting Yemeni territory aimed at degrading Houthi capabilities.

- On February 18, the Houthis successfully targeted “Rubymar,” a UK-owned merchant vessel, with an anti-ship ballistic missile (ASBM) in the Gulf of Aden. This was the first instance since the start of the Houthi campaign in which a ship was rendered completely dysfunctional and abandoned by its crew. It eventually sank on March 2.

- On March 5, the Houthis successfully targeted the Liberian-owned ship True Confidence in the Gulf of Aden, killing three foreign crew members. This marked the first instance since the beginning of the Houthi campaign in which fatalities were recorded among seafarers.

- On March 12, the Houthi Military Spokesperson, Yahya Saree, pledged to escalate the movement’s attacks during the month of Ramadan.

- On March 14, the Houthi movement pledged to escalate their attacks and pursue “Israeli-linked” vessels in the Indian Ocean.

- On March 18, the US Department of Transportation’s (DOT’s) Maritime Administration advised US-flagged vessels to turn off their Automatic Identification System (AIS) transponders when transiting the Southern Red Sea, Bab al-Mandab Strait, and the Gulf of Aden.

Shipping-related developments

- In February, the International Transport Workers Federation (ITF), a major seafarer rights union, announced the expansion of the International Bargaining Group’s (IBF) High-Risk Areas to encompass the Gulf of Aden and adjacent waters. The IBF is a forum that brings together the ITF and international maritime employers. The change granted seafarers the right to refuse sailing into the area and strengthened repatriation and compensation mechanisms for seafarers.

- In March, major shipping companies, including Maersk and Hapag-Lloyd, reaffirmed their decisions to suspend shipping through the Red Sea and reroute shipments through South Africa’s Cape of Good Hope.

- According to an International Monetary Fund (IMF) statement from March 7, in the first two months of 2024, trade volume passing through the Suez Canal decreased by 50 percent. Meanwhile, trade transiting around the Cape of Good Hope surged by 74 percent year-on-year.

- On March 2, the US State Department stated that the Houthi attacks on commercial shipping in the Red Sea are doubling shipping costs to the US and increasing food, medicine, and fuel prices.

Assessments & Forecast

Houthis project escalation, continue threatening vessels despite Western-led security umbrellas

- The Houthis continued to launch attacks against commercial vessels despite the US-led OPG that has been ongoing since December 18, the more recent deployment of the EU-led operation, and the multiple rounds of US and UK airstrikes against Houthi infrastructures within Yemeni. This, together with the latest shipping-related developments (outlined above), highlights the continued knock-on effects the Houthi campaign has on global shipping and the limitations of Western-led efforts to ensure security along the major shipping route. This was highlighted in the US DOT’s March 18 recommendations to US-flagged vessels to take special precautions when traversing the maritime route. It is also highlighted by the continued reluctance of major shipping firms to resume travel in the waterway.

- This reluctance likely partly emanates from the understanding that amid persistent Houthi aerial attacks, vessels’ security cannot be guaranteed by conventional measures that firms can take themselves. Instead, they are predicated on an international-level military or political solution that has yet to materialize. These perceptions also affect international seafarers’ labor unions, who are increasingly concerned about the situation and exert further pressures on shipping firms, as highlighted in the ITF-related developments.

Recent attacks highlight Houthi capabilities to strike targets at sea

The Houthi attacks against the UK-owned Rubymar and Liberia-owned True Confidence were particularly notable. The attack on Rubymar not only constituted the first attack following which a ship sank, but it also turned the vessel into a regional environmental hazard given that it was carrying ammonium phosphate sulfate fertilizer that may spill. The attack on True Confidence constitutes the first instance in which the Houthis caused fatalities in an attack. Picture material depicting the incident shows that the attack impacted the vessel’s Bridge, the area from where the captain and crew navigate the ship. Both Rubymar and True Confidence were targeted with Houthi anti-ship ballistic missiles (ASBMs) in the Gulf of Aden. This highlights the Houthis’ ability to not only conduct precision ASBM strikes but also conduct them in the Gulf of Aden. This highlights that they can launch successful missile attacks beyond their immediate backyard of the Red Sea and its coastal areas that they control.

Houthis shift to conduct more attacks in Gulf of Aden compared to Red Sea

The abovementioned attacks also correspond to a broader trend since mid-January, in which the Houthis are increasingly targeting the Gulf of Aden, diverging from their previous focus on the Red Sea during November-December 2023. It is plausible that the Houthis made this decision due to the countermeasures introduced by the US- and EU-led security operations. By expanding the geographical scope of their attacks, the Houthis likely wish to stretch these coalitions’ assets across Yemen’s surrounding waters, thus rendering their ability to intercept Houthi aerial attacks less effective. It also allows the Iran-backed movement to project prowess vis-a-vis the West. This desire would also strengthen the Houthi motivation to at least try to launch attacks beyond the confines of the Gulf of Aden, further into the Arabian Sea.

Houthis’ use of water-borne attack platforms

- Another way the Houthis seek to challenge the Western-led maritime operations is by using water-borne attack platforms. This was highlighted in several instances since February in which US Navy forces announced they intercepted Houthi unmanned surface vessels (USVs) (remote-controlled explosive-laden fast boats) and [explosive-laden] unmanned underwater vessels (UUVs). The use of UUVs has not been well documented in the arena thus far, and the Houthi movement has yet to introduce or claim them on official channels. This renders the US announcements notable, highlighting that the Houthis continue developing their arsenal of water-borne attack platforms.

- Unlike air-borne arms, water-borne devices require the Houthis to launch them from their coastal areas of control. Thus, they will likely pose a more viable threat in and around the Red Sea. Regardless, it still compounds the challenges facing the international coalitions in their efforts to closely monitor the maritime arena around Yemen and underscore the risks posed to commercial vessels in the Red Sea.

Houthis’ greater emphasis on attacks against US, UK-owned vessels

- The Houthis’ initial focus (November-December) was to claim attacks on ships purportedly associated with Israel and ones that are bound for Israel. However, in light of the US and UK’s strikes in Yemen, this has been extended to US and UK-linked ships. This was highlighted in numerous statements by Houthi leaders, the attack against Rubymar (a UK-owned vessel), and at least one instance in which the Houthis attempted to target a US-owned, flagged, and operated vessel in February. The Houthis’ pursuit of UK and US-owned vessels is also underscored in the characteristics of firms owning ships that were attacked thus far in 2024, of which around 46 percent are registered in the US and UK.

- This shows that the repeated US-UK-led strikes against Houthi assets in Yemen not only failed to deter the Houthis from engaging in attacks but also prompted them to try to exact a price from US and UK-linked shipping firms. It highlights the Houthis’ audacity vis-a-vis the West, which is also highlighted in their current threats to expand their attacks into maritime zones in the Indian Ocean. With all of the above, the Houthis project a qualitative escalation in their campaign to target commercial vessels, which will partly be compounded by the religious fervor and symbolism associated with the current period of Ramadan (until April 9).

Possible Houthi intelligence gaps, risks of misidentification of vessels

- Regardless of the Houthi discourse and focus on Israeli, American, and British ships, many other foreign firms, as well as crewmembers of diverse origins, are impacted by the Houthi attacks. There were also instances that pointed to misidentification by the Houthis in recent months, which can likely be partially attributed to the complex and dynamic nature of ownership in the maritime shipping industry. For instance, in January, the Houthis targeted a vessel with opaque ownership that may have been transporting Russian oil. The ship was reportedly sold by a UK-based firm several months before the attack. Its previous British ownership appears to have been the only reason the Houthis would decide to attack it. Similarly, True Confidence, which the Houthis designated as “American,” reportedly only belonged to a US firm in the past. In February, the Houthis targeted another alleged “American” ship, Star Iris. It was a Greek-owned vessel reportedly transporting grain to Iran, the Houthis’ primary backer.

- All of the above point to risks of misidentification and miscalculations in the Houthi effort to choose targets at sea, which can result from poor or outdated intelligence. This further compounds the threat posed to international shipping firms as a whole.

Forecast

- The Houthis will likely launch additional maritime attacks in the short-to-medium term despite the bolstered international efforts to offset the threat. This will continue to impact global shipping firms, which will continue to be reluctant to resume operations through the Gulf of Aden/Red Sea. This will increase delays and shipment costs due to issues such as length of journey, security, insurance, and seafarers’ demands for compensation associated with increased risks. This is liable to be compounded by the threat of piracy off the coast of Somalia, which was recently highlighted on March 12.

- The prolongation of the Houthi campaign will thus likely continue to impact global supply chains, compounding prices of goods and inflationary pressures. This will be bolstered by additional challenges in major maritime chokepoints, such as disruptions to trade in the Panama Canal prompted by drought and infrastructural limitations in ports throughout Africa.

Houthis unlikely to extend hostilities to Gulf states

- The period before the launching of the US-led OPG in December was characterized by uncertainty regarding the potential for escalation that would involve Houthi attacks against their regional foes:– Saudi Arabia, the UAE, and Bahrain. The Houthis threatened and attempted to deter these states from associating themselves with the US-led operation. Riyadh and Abu Dhabi indeed kept a low profile and did not extend support to the US-led initiative, at least publicly. This highlights both states’ reluctance to provoke the Houthis and safeguard their primary interest vis-a-vis the Iran-backed movement– namely, to preserve calm and strive to extend the Yemen ceasefire.

- Bahrain is at a comparatively greater risk of retaliatory attacks by the Houthis. This is because, unlike Riyadh and Abu Dhabi, Manama has officially and publicly associated itself with the US-led OPG. Bahrain also facilitates US and UK airstrikes in Yemen, as indicated by public statements from US CENTCOM. Consequently, Bahrain faces a comparatively higher risk of prompting Houthi attacks against it as a price tag for explicitly siding with the US against them.

- That said, the Houthis did not extend hostilities to aerial attacks against Gulf states, including Bahrain. This is despite the launching of the US-led maritime coalition and numerous US- and UK-led airstrikes in Yemen over the past months. This suggests that the Houthis currently retain an interest in not provoking these states and do not seek to exact a price from them for US-led action. This is likely reflective of the Houthi goal of isolating Israel, the US, and the UK and challenging their Middle East policies without embroiling other regional actors. Furthermore, the Houthis also expressed their interest in advancing UN-mediated negotiations to extend the Yemen truce, as highlighted in recent UN statements. This highlights that the Houthis still share a desire for calm within the context of the Yemen civil war, further motivating the Houthis not to escalate hostilities with the Saudi-led camp. Recent remarks by Houthi officials further corroborate this desire for de-confliction. FORECAST: Thus, the Houthis are unlikely to extend their campaign to encompass aerial attacks against Gulf states at the current juncture.

Recommendations

- Businesses and consumers worldwide are advised to allot for further supply chain disruptions and cost increases due to continued Houthi attacks in and around the Red Sea and Gulf of Aden.

- Monitor regional events related to the Israel-Hamas conflict, given their corresponding link to the Houthi campaign at sea.

- Those traveling in and around Middle Eastern maritime zones, including in the Indian Ocean, should remain apprised of UKMTO and US DOT Maritime Administration-issued notices, as well as being aware of NATO Shipping Center alerts.

- As per US DOT recommendations, US-flagged commercial vessels are advised to coordinate voyage planning with US Naval Forces Central Command (NAVCENT) Naval Cooperation and Guidance for Shipping (NCAGS) and consider their specific recommendations and guidance.

- For essential Red Sea travel, review ships’ ownership and management history for past links to the US, UK, and Israel.

- Remain vigilant for suspicious objects, actors, and possible threats at sea.

- Ensure crewmembers’ security awareness, contingency plans, and ability to respond to incidents at sea.

- Owners and operators of vessels potentially involved in legal cases relating to the US sanctions regimes on Iran are advised to conduct risk assessments before traveling near Iranian waters, given the risk of detention by Iranian authorities.

- For any questions and/or risk assessments, contact us at [email protected].