13

Oct 2022

15:17 UTC

Yemen Analysis: Houthis reveal new anti-ship missiles at parades in September; reflects growing capacity to target vessels off coast of Yemen

Executive Summary:

- On September 1 and 21, the Houthis held military parades in Hodeidah and Sanaa, during which they demonstrated several surface-to-sea missiles, some of which were new.

- The possession of these anti-ship arms likely reflects successful technical support provided to the Houthis by Iran through the smuggling of weapon components and/or the transfer of technical know-how to manufacture such arms.

- This development will likely increase the Houthis’ ability to attack sea targets around Yemen and elevate its leverage over, and ability to deter, its foes in the Gulf of Aden, Bab al-Mandab Strait, and the Red Sea, including in maritime zones near southern Saudi Arabia.

- It will also likely somewhat bolster Houthi deterrence vis-a-vis the Saudi-backed Presidential Command Council (PCC) and international stakeholders seeking to revive Yemeni gas exports through Shabwa’s export terminals.

- The threat perception of regional states that are engaged in the region and oppose the Houthis will increase. This will lead to greater militarization in waters surrounding Yemen as well as an increase in surveillance and offensive operations by the Saudi-led Coalition to destroy Houthi anti-ship capabilities on Yemeni soil.

Assessments & Forecast:

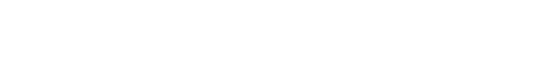

Missiles point to Iran’s direct, recent involvement in developing the Houthis’ anti-ship capabilities

- The Houthis’ possession of anti-ship missile capabilities is not unprecedented. The movement inherited missile systems from Yemeni army stockpiles that existed before the start of the civil war in 2014, such as the Soviet “Rubezh” system. The Houthis also officially designated the “al-Mandab 1” missile in 2017, which they stated was based on the Chinese C-801 missile. Their possession of this capability has also resulted in their active use against targets at sea, most notably, against the US Navy’s USS Mason in October 2016.

- There have been no similar missile attacks in recent years, suggesting that the Houthis may have faced operational challenges in this respect or opted to develop capabilities against land targets. However, there are indications from recent years that the Houthis have continued to try to acquire and develop an anti-ship missile arsenal. For instance, in November 2019, the US Central Command (CENTCOM) announced the interception of a smuggling boat on its way to Yemen that contained Iranian-made “Noor”/C-802 missile components. This shipment specifically included the missile’s homing radar cabins. Houthi forces were not known to possess this specific type of anti-ship missile prior to this discovery. Therefore, it was an indication that they seek a qualitative leap in this field. Since then, there were no announcements of interceptions of vessels carrying anti-ship missile components to Yemen. However, indications of attempts to smuggle sophisticated Iranian arms into Houthi hands have continued. For instance, in early 2022, UK and US navy vessels intercepted speedboats containing dozens of packages with advanced Iranian arms, including anti-aircraft missiles and engines for land attack cruise missiles, that were likely destined for Yemen.

- These incidents are part of a broader trend of military support provided by Iran to its regional allies, including the Houthis. In this context, the Houthi forces annually reveal new arms that can be launched far beyond Yemen’s territorial boundaries that bear Iranian footprints and, in some cases, blueprints that are identical to Iranian weapon systems. This pertains to both missiles and explosive-laden unmanned aerial vehicles (UAVs). For instance, in March 2021, Houthi forces revealed their “Waid” explosive-laden UAV, which bears the exact design of Iran’s “Shahed-136” loitering munition (from Iran’s signature Delta Wing family). The Houthis’ longest-range ballistic missile (at least until September 2022), “Zulfiqar”, which was used by the Houthis to target the capitals of both Saudi Arabia and the UAE, is based on the Iranian Qiam system. In the latest military parades in September 2022, Houthi forces further revealed another long-range ballistic missile dubbed “Hatem,” which is identical, both in design and in colors, to Iran’s “Kheibar Shekan.” The latter was only designated by Iran in February of this year and is announced to have a range of 1450 km. This was the latest instance of Iranian support for the Houthis by means of transferring the technical know-how and/or the smuggling of hardware to the Shiite group.

- As was well established in the UAV and ballistic missile spheres, the Houthis’ latest exhibition of arms indicates that they were also able to successfully acquire Tehran’s assistance with developing their anti-ship missile arsenal. This likely includes the transfer of “Noor”/C-802 missile components or even more sophisticated systems like the “Ghadir” or “Qader” (a variant of the Noor family) which the Houthis dubbed “al-Mandab 2”. This is supported by the fact that the newly revealed “al-Mandab 2” bears the blueprint of these Iranian systems. This includes the three sets of trapezoid-shaped fins on the missile. While the reintroduced “al-Mandab 1” also shares these overarching physical characteristics, the picture material and Houthi statements indicate that “al-Mandab 2” is at least one meter longer than “al-Mandab 1”, indicating in turn that they are distinct systems. Accordingly, the Houthis’ declared range of the “al-Mandab 2”, namely “more than 300 km”, is another indication that it is based on more sophisticated Iranian designs than the C-801.

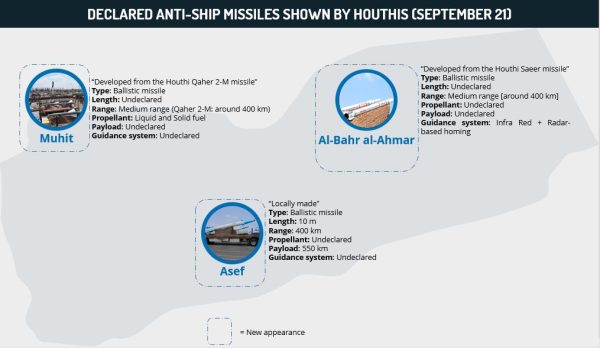

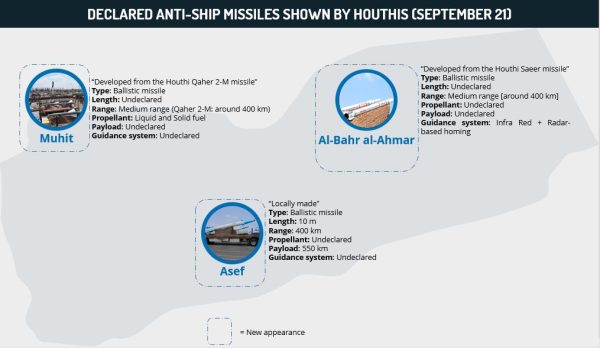

- In the same vein, the newly introduced “Falaq 1” appears to be a variant of Iran’s “Fajr-4CL” (F4CL) guided munition that is equipped with electro-optical guidance. According to the Houthis, this includes a target-capturing capacity through both heat-seeking (infrared emission) and imaging. With such a system, a projectile can be potentially launched to sea and home in on targets using a television camera mounted on its guidance system that provides better acquisition of targets than mere infrared homing, such as optical contrast seeking. This characteristic is corroborated by the fact that the picture material showing the Houthi missile clearly indicates the existence of such cameras. Additional newly presented missiles with electro-optical systems include the “Asef” surface-to-sea ballistic missile, with a reported range of 400km, the “Muhit” (“Ocean”) (which is based on the Houthis’ Qaher 2-M, a ballistic missile with a range of 400km), and “al-Bahr al-Ahmar” (“Red Sea”) missile (which is based on the medium-range “Saeer” ballistic missile and according to the Houthis has an infra-red and radar-based homing system).

- Most of these designs also bear some traditional footprints of Iranian guided missiles, such as the two sets of fixed trapezoid or triangle-shaped fins on the tail, and triangular fins close to the guidance system at the top of the missile. These missiles also point to the trend of converting surface-to-surface ballistic missiles into anti-ship missiles, which again is likely facilitated by extensive engineering support from Tehran. This poses a risk due to the generally high speed at which ballistic missiles fly, which would make them difficult to intercept even by warships with defense capabilities. A greater ability to seek and home in on targets further away from Yemeni territorial waters will thus broadly increase the Houthis’ ability to pose a risk to vessels at sea.

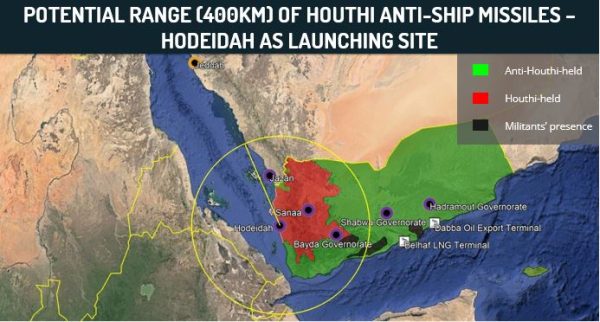

Increased risk, growing Houthi deterrence in waters surrounding Yemen

- The Houthis have yet to use and prove the precision and ranges of their newly declared anti-ship missiles. However, the details showcasing Iran’s signature footprint which can partly be corroborated through the pictures and footage from the parades, lend some credence to the Houthis’ declarations that some of their new missiles have ranges of between 200-400 km, similar to some of the Iranian systems. FORECAST: Thus, this will likely increase the Houthis’ ability to attack targets at sea, and by extension, increase Houthi deterrence in the Gulf of Aden, Bab al-Mandab Strait, and the Red Sea. This could also extend to maritime territories of Saudi Arabia’s Jazan, Assir, and even the southern tip of Mecca Province.

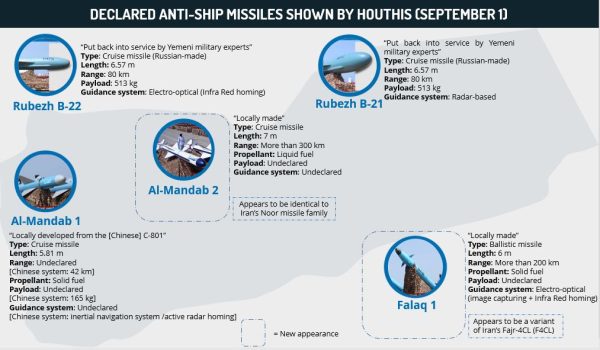

- Such deterrence is important for the Houthis in two distinct regards. First, they wish to be able to target military vessels employed by the Saudi-led Coalition, which imposes a naval blockade over Houthi-controlled territories. The Houthi slogan of “Breaking the Siege” is a strategic goal for the movement vis-a-vis the coalition forces and the ability to target naval vessels during times of military escalation would serve their broad operational interests. Secondly, the Houthis continue to maintain that the Saudi-led Coalition, backed by the US and the “Zionists” [Israel], are looting Yemen of its natural resources, partly using foreign tankers and companies. According to Houthi-affiliated media, the total amount of crude “stolen” from Yemen’s anti-Houthi-controlled areas (spanning from Shabwa’s Bir Ali to Hadramout’s Dabba oil export terminal in Ash Shihr) between January 2021 and mid-2022 amounted to 24,700,000 barrels of crude oil. The report specified several foreign-flagged vessels that allegedly partook in these operations.

- FORECAST: The Houthis are likely to leverage their bolstered maritime military capability to increase their deterrence vis-a-vis firms and vessels that may arrive in Yemen to load oil and gas, even if such arrangements are coordinated and established legally with the internationally recognized anti-Houthi authorities. This specifically pertains to Shabwa’s PCC-controlled Belhaf liquified natural gas (LNG) export terminal, which the anti-Houthi camp is attempting to reinstate. Should the Houthis prove their actual capability and resolve to strike areas in and off coast Shabwa, it would serve as a deterrent against companies showing interest in the Yemeni oil and gas industries. This, in turn, would possibly curtail the reintegration of Yemen into the global oil and gas markets and deprive the Saudi-backed, anti-Houthi authorities of much-needed revenue and legitimacy. In this context, while still unlikely given precedent, missile attacks against foreign vessels docking at these southern Yemeni ports and perceived by the Houthis to be looting the country’s resources cannot be entirely ruled out. Such attacks, however, would require the Houthis to transfer missiles and set up launch sites in their southeasternmost areas of control, namely, the Bayda Governorate. The Houthis’ ability to identify vessels that dock at these ports and subsequently threaten such specific vessels could be partially facilitated by the use of publicly available online maritime traffic platforms that track vessels’ automatic identification system (AIS), which the Houthis have proved to have effectively used.

- FORECAST: The development will elevate the threat perception and alertness of regional states that are engaged in the region and oppose the Houthis or are perceived by the Houthis to be an adversary. This will likely particularly involve the active members of the Saudi-led Coalition. The latter will likely employ greater aerial surveillance in order to locate and subsequently destroy Houthi anti-ship missile systems prior to their use, as the Coalition also conducts against ballistic missiles and UAV launch sites. The Coalition is also likely to resort to greater militarization in waters surrounding Yemen and continue to enforce the naval blockade over Houthi-controlled territories, which the Houthis deem unacceptable. This will perpetuate the volatility of the security environment in the country. More broadly, Yemen will continue to be a focal point for hostilities between the pro-Iran and pro-Saudi axes and an arena for strategic geopolitical leverage given the country’s location on a major maritime route connecting Asia and Europe.

Recommendations:

- Those managing or operating vessels in the Red Sea, Bab al-Mandab Strait, Gulf of Aden, and Arabian Sea, and conducting business in Yemen are advised to maintain vigilance in the area. This is due to the slightly increased potential for Houthi missile and UAV attacks against vessels within Yemeni maritime borders and more rarely in international waterways near these areas.

- Remain apprised of UKMTO and US DOT Maritime Administration-issued notices as well as NATO Shipping Center alerts.

- Remain vigilant of suspicious vessels and objects at sea, which can potentially be explosive-laden fast boats (often disguised as fishing boats) and sea mines, respectively.

- Remain abreast of statements and rhetoric employed by Houthi official and unofficial channels given the proclivity of the movement to follow through on threats against its adversaries.

- Prior to investing or operating in Yemen, contact us at [email protected] for a customized risk assessment to minimize the exposure of personnel and assets to threats in the country. It is also advised to consult with [email protected] regarding potential on-ground security services.

Executive Summary:

- On September 1 and 21, the Houthis held military parades in Hodeidah and Sanaa, during which they demonstrated several surface-to-sea missiles, some of which were new.

- The possession of these anti-ship arms likely reflects successful technical support provided to the Houthis by Iran through the smuggling of weapon components and/or the transfer of technical know-how to manufacture such arms.

- This development will likely increase the Houthis’ ability to attack sea targets around Yemen and elevate its leverage over, and ability to deter, its foes in the Gulf of Aden, Bab al-Mandab Strait, and the Red Sea, including in maritime zones near southern Saudi Arabia.

- It will also likely somewhat bolster Houthi deterrence vis-a-vis the Saudi-backed Presidential Command Council (PCC) and international stakeholders seeking to revive Yemeni gas exports through Shabwa’s export terminals.

- The threat perception of regional states that are engaged in the region and oppose the Houthis will increase. This will lead to greater militarization in waters surrounding Yemen as well as an increase in surveillance and offensive operations by the Saudi-led Coalition to destroy Houthi anti-ship capabilities on Yemeni soil.

Assessments & Forecast:

Missiles point to Iran’s direct, recent involvement in developing the Houthis’ anti-ship capabilities

- The Houthis’ possession of anti-ship missile capabilities is not unprecedented. The movement inherited missile systems from Yemeni army stockpiles that existed before the start of the civil war in 2014, such as the Soviet “Rubezh” system. The Houthis also officially designated the “al-Mandab 1” missile in 2017, which they stated was based on the Chinese C-801 missile. Their possession of this capability has also resulted in their active use against targets at sea, most notably, against the US Navy’s USS Mason in October 2016.

- There have been no similar missile attacks in recent years, suggesting that the Houthis may have faced operational challenges in this respect or opted to develop capabilities against land targets. However, there are indications from recent years that the Houthis have continued to try to acquire and develop an anti-ship missile arsenal. For instance, in November 2019, the US Central Command (CENTCOM) announced the interception of a smuggling boat on its way to Yemen that contained Iranian-made “Noor”/C-802 missile components. This shipment specifically included the missile’s homing radar cabins. Houthi forces were not known to possess this specific type of anti-ship missile prior to this discovery. Therefore, it was an indication that they seek a qualitative leap in this field. Since then, there were no announcements of interceptions of vessels carrying anti-ship missile components to Yemen. However, indications of attempts to smuggle sophisticated Iranian arms into Houthi hands have continued. For instance, in early 2022, UK and US navy vessels intercepted speedboats containing dozens of packages with advanced Iranian arms, including anti-aircraft missiles and engines for land attack cruise missiles, that were likely destined for Yemen.

- These incidents are part of a broader trend of military support provided by Iran to its regional allies, including the Houthis. In this context, the Houthi forces annually reveal new arms that can be launched far beyond Yemen’s territorial boundaries that bear Iranian footprints and, in some cases, blueprints that are identical to Iranian weapon systems. This pertains to both missiles and explosive-laden unmanned aerial vehicles (UAVs). For instance, in March 2021, Houthi forces revealed their “Waid” explosive-laden UAV, which bears the exact design of Iran’s “Shahed-136” loitering munition (from Iran’s signature Delta Wing family). The Houthis’ longest-range ballistic missile (at least until September 2022), “Zulfiqar”, which was used by the Houthis to target the capitals of both Saudi Arabia and the UAE, is based on the Iranian Qiam system. In the latest military parades in September 2022, Houthi forces further revealed another long-range ballistic missile dubbed “Hatem,” which is identical, both in design and in colors, to Iran’s “Kheibar Shekan.” The latter was only designated by Iran in February of this year and is announced to have a range of 1450 km. This was the latest instance of Iranian support for the Houthis by means of transferring the technical know-how and/or the smuggling of hardware to the Shiite group.

- As was well established in the UAV and ballistic missile spheres, the Houthis’ latest exhibition of arms indicates that they were also able to successfully acquire Tehran’s assistance with developing their anti-ship missile arsenal. This likely includes the transfer of “Noor”/C-802 missile components or even more sophisticated systems like the “Ghadir” or “Qader” (a variant of the Noor family) which the Houthis dubbed “al-Mandab 2”. This is supported by the fact that the newly revealed “al-Mandab 2” bears the blueprint of these Iranian systems. This includes the three sets of trapezoid-shaped fins on the missile. While the reintroduced “al-Mandab 1” also shares these overarching physical characteristics, the picture material and Houthi statements indicate that “al-Mandab 2” is at least one meter longer than “al-Mandab 1”, indicating in turn that they are distinct systems. Accordingly, the Houthis’ declared range of the “al-Mandab 2”, namely “more than 300 km”, is another indication that it is based on more sophisticated Iranian designs than the C-801.

- In the same vein, the newly introduced “Falaq 1” appears to be a variant of Iran’s “Fajr-4CL” (F4CL) guided munition that is equipped with electro-optical guidance. According to the Houthis, this includes a target-capturing capacity through both heat-seeking (infrared emission) and imaging. With such a system, a projectile can be potentially launched to sea and home in on targets using a television camera mounted on its guidance system that provides better acquisition of targets than mere infrared homing, such as optical contrast seeking. This characteristic is corroborated by the fact that the picture material showing the Houthi missile clearly indicates the existence of such cameras. Additional newly presented missiles with electro-optical systems include the “Asef” surface-to-sea ballistic missile, with a reported range of 400km, the “Muhit” (“Ocean”) (which is based on the Houthis’ Qaher 2-M, a ballistic missile with a range of 400km), and “al-Bahr al-Ahmar” (“Red Sea”) missile (which is based on the medium-range “Saeer” ballistic missile and according to the Houthis has an infra-red and radar-based homing system).

- Most of these designs also bear some traditional footprints of Iranian guided missiles, such as the two sets of fixed trapezoid or triangle-shaped fins on the tail, and triangular fins close to the guidance system at the top of the missile. These missiles also point to the trend of converting surface-to-surface ballistic missiles into anti-ship missiles, which again is likely facilitated by extensive engineering support from Tehran. This poses a risk due to the generally high speed at which ballistic missiles fly, which would make them difficult to intercept even by warships with defense capabilities. A greater ability to seek and home in on targets further away from Yemeni territorial waters will thus broadly increase the Houthis’ ability to pose a risk to vessels at sea.

Increased risk, growing Houthi deterrence in waters surrounding Yemen

- The Houthis have yet to use and prove the precision and ranges of their newly declared anti-ship missiles. However, the details showcasing Iran’s signature footprint which can partly be corroborated through the pictures and footage from the parades, lend some credence to the Houthis’ declarations that some of their new missiles have ranges of between 200-400 km, similar to some of the Iranian systems. FORECAST: Thus, this will likely increase the Houthis’ ability to attack targets at sea, and by extension, increase Houthi deterrence in the Gulf of Aden, Bab al-Mandab Strait, and the Red Sea. This could also extend to maritime territories of Saudi Arabia’s Jazan, Assir, and even the southern tip of Mecca Province.

- Such deterrence is important for the Houthis in two distinct regards. First, they wish to be able to target military vessels employed by the Saudi-led Coalition, which imposes a naval blockade over Houthi-controlled territories. The Houthi slogan of “Breaking the Siege” is a strategic goal for the movement vis-a-vis the coalition forces and the ability to target naval vessels during times of military escalation would serve their broad operational interests. Secondly, the Houthis continue to maintain that the Saudi-led Coalition, backed by the US and the “Zionists” [Israel], are looting Yemen of its natural resources, partly using foreign tankers and companies. According to Houthi-affiliated media, the total amount of crude “stolen” from Yemen’s anti-Houthi-controlled areas (spanning from Shabwa’s Bir Ali to Hadramout’s Dabba oil export terminal in Ash Shihr) between January 2021 and mid-2022 amounted to 24,700,000 barrels of crude oil. The report specified several foreign-flagged vessels that allegedly partook in these operations.

- FORECAST: The Houthis are likely to leverage their bolstered maritime military capability to increase their deterrence vis-a-vis firms and vessels that may arrive in Yemen to load oil and gas, even if such arrangements are coordinated and established legally with the internationally recognized anti-Houthi authorities. This specifically pertains to Shabwa’s PCC-controlled Belhaf liquified natural gas (LNG) export terminal, which the anti-Houthi camp is attempting to reinstate. Should the Houthis prove their actual capability and resolve to strike areas in and off coast Shabwa, it would serve as a deterrent against companies showing interest in the Yemeni oil and gas industries. This, in turn, would possibly curtail the reintegration of Yemen into the global oil and gas markets and deprive the Saudi-backed, anti-Houthi authorities of much-needed revenue and legitimacy. In this context, while still unlikely given precedent, missile attacks against foreign vessels docking at these southern Yemeni ports and perceived by the Houthis to be looting the country’s resources cannot be entirely ruled out. Such attacks, however, would require the Houthis to transfer missiles and set up launch sites in their southeasternmost areas of control, namely, the Bayda Governorate. The Houthis’ ability to identify vessels that dock at these ports and subsequently threaten such specific vessels could be partially facilitated by the use of publicly available online maritime traffic platforms that track vessels’ automatic identification system (AIS), which the Houthis have proved to have effectively used.

- FORECAST: The development will elevate the threat perception and alertness of regional states that are engaged in the region and oppose the Houthis or are perceived by the Houthis to be an adversary. This will likely particularly involve the active members of the Saudi-led Coalition. The latter will likely employ greater aerial surveillance in order to locate and subsequently destroy Houthi anti-ship missile systems prior to their use, as the Coalition also conducts against ballistic missiles and UAV launch sites. The Coalition is also likely to resort to greater militarization in waters surrounding Yemen and continue to enforce the naval blockade over Houthi-controlled territories, which the Houthis deem unacceptable. This will perpetuate the volatility of the security environment in the country. More broadly, Yemen will continue to be a focal point for hostilities between the pro-Iran and pro-Saudi axes and an arena for strategic geopolitical leverage given the country’s location on a major maritime route connecting Asia and Europe.

Recommendations:

- Those managing or operating vessels in the Red Sea, Bab al-Mandab Strait, Gulf of Aden, and Arabian Sea, and conducting business in Yemen are advised to maintain vigilance in the area. This is due to the slightly increased potential for Houthi missile and UAV attacks against vessels within Yemeni maritime borders and more rarely in international waterways near these areas.

- Remain apprised of UKMTO and US DOT Maritime Administration-issued notices as well as NATO Shipping Center alerts.

- Remain vigilant of suspicious vessels and objects at sea, which can potentially be explosive-laden fast boats (often disguised as fishing boats) and sea mines, respectively.

- Remain abreast of statements and rhetoric employed by Houthi official and unofficial channels given the proclivity of the movement to follow through on threats against its adversaries.

- Prior to investing or operating in Yemen, contact us at [email protected] for a customized risk assessment to minimize the exposure of personnel and assets to threats in the country. It is also advised to consult with [email protected] regarding potential on-ground security services.