Oil & Gas Snapshot: Guyana: Increased crude oil exports, foreign investments to continue despite limitations over Essequibo conflict, climate change concerns

Highlights

- While military escalations in the Guyana-administered Essequibo region remain unlikely, the potential for intimidatory tactics by Caracas against oil facilities cannot be ruled out.

- Deepening ties between Guyana-China under the BRI Initiative increases scope for greater bilateral engagements in the energy sector.

- Despite the political impact of ethnic tensions between Indo-Guyanese and Afro-Guyanese groups, the energy sector is unlikely to be negatively affected due to the shared economic interests in the sector.

- Increased judicial scrutiny on environmental impact assessments may marginally elevate insurance costs for companies.

Introduction

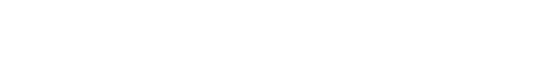

- Guyana, the world’s fastest-growing economy, achieved its inaugural commercial crude oil draw in December 2019, solidifying its status as one of the newest petroleum-producing regions globally. Historically, as a net fuel importer, with its offshore Guyana Basin and inland Takatu Basin, Guyana has drawn the interest of foreign oil companies since the 1940s, conducting extensive geological surveys and drilling wells.

- A September 2023 report by the International Monetary Fund (IMF) on Guyana’s economy underlines that the country’s economy continues to develop extremely “rapidly” as a result of the government’s modernization programs, which are mostly supported by money generated from the expansion of the oil industry.

- National oil in 2023 generated one billion USD in yearly income and is expected to generate 7.5 billion USD by 2040. With predicted oil production increases, Guyana is on track to become the world’s fourth-largest offshore oil producer.

- In 2023, Guyana’s real GDP expanded by 33 percent, while the non-oil, real economy expanded by 11.7 percent.

Geopolitics

While alternative forms of energy exploration including fossil fuels and biomass are predicted to expand, Guyana’s crude oil industry will continue to dominate the commercial oil market, especially following its expansive crude oil explorations in 2015 and 2019. This is particularly likely as global players, including Canada, the UK, USA, as well as China, will seek to further diversify conventional energy sources amid the expected long-term market volatility stemming from the Middle East and the Russia-Ukraine conflicts.

Given Guyana’s successful exploration campaigns and production of one million barrels of commercial crude oil per day (with an expectation of 1.2 million barrels of crude oil per day by 2027), the country will possibly stand to challenge OPEC+’s influence in the global supply chain market, which has been announcing production cuts in a bid to control crude prices. This is supported by the country’s expansionist oil projects and drilling campaigns growing at a steady pace. Some examples of this include the Payara offshore project already producing 220,000 barrels per day as of January 2024 and the approval of the consortium of the Uaru project expected to produce 250,000 barrels per day in 2026.

Territorial tensions with Venezuela

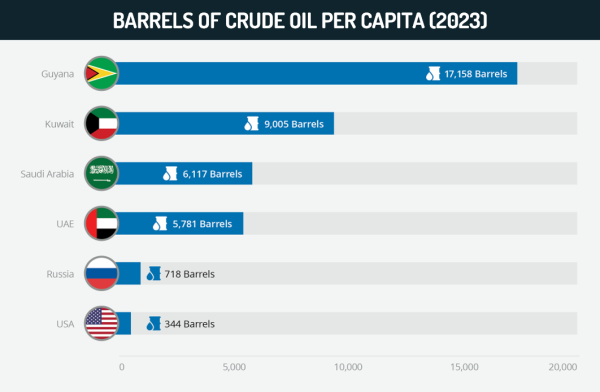

Guyana’s longstanding territorial dispute with Venezuela over the hydrocarbon-rich Essequibo region, despite the January 25 pledge by both countries to maintain peace, will continue to be an underlying concern for the energy sector through the medium term. This mainly stems from the diplomatic escalations following the Caracas-led referendum in Essequibo in December 2023, with Venezuelan Defense Minister Vladimir Padrino announcing on February 9 to conduct a “proportional, forceful” operation against proposed oil drilling in the contested region.

Guyanese President Irfaan Ali has asserted that oil drilling operations will proceed according to the original plan. Given this, Caracas will likely continue to adopt intimidatory tactics in the form of increased military deployment near its borders, especially as an attempt to shore up domestic public appeal with President Nicolas Maduro seeking re-election in July 2024 elections amid Venezuela’s dire economic situation. Increased Venezuelan military presence was reported at its Anacoco Island Base on January 13 and Punta Barima in early-February, alongside improvement of roads and other infrastructural facilities near the two areas. Based on precedent, the possibility of Venezuelan Navy-led interceptions of an oil company’s ship off the Essequibo region cannot be entirely ruled out, especially if a project materializes in Guyana’s Exclusive Economic Zone, disputed by Caracas. For instance, in December 2018, a Venezuelan military helicopter attempted to land on the deck of an US-based oil company’s contracted vessel within the Stabroek Block. In October 2013, Venezuelan Navy detained the crew of a Texas-based petroleum company’s vessel conducting a seabed survey off Essequibo for “carrying out illegal activities”. Similar attempts remain possible in the coming months, especially with the US-based company announcing plans on February 9 to explore two new offshore exploratory wells in the Stabroek Block.

As a result, increased Guyanese military preparedness can also be expected going forward, especially with Ali announcing to increase the 2024 defense budget. Joint military drills between Guyana and the UK and the USA also remain likely. Despite this, the potential for a Caracas-led military confrontation will continue to remain limited, especially as such a move will severe the prospects of temporarily eased Washington-led sanctions on Venezuela’s oil, gold, and secondary financial markets, due a review in April.

Against the backdrop of the ongoing Essequibo conflict, Guyana will likely continue to limit operations and exploration activities, particularly those near Venezuelan waters, specifically above the “70-degree line” of their borders. This is supported by the Guyanese officials announcing on February 21 to refrain from approving energy activities south of the delimited waters until the International Court of Justice makes a ruling on the territorial dispute concerning the Essequibo region. This indicates Georgetown’s cautious approach, aimed at avoiding further escalation of tensions with Venezuela.

Ties with China

Guyana and China released a joint statement conveying their willingness to cooperation under the Belt and Road Initiative (BRI) on July 31, 2023. This increased cooperation is also manifested in Ali committing to linking Guyana’s Low Carbon Development Strategy (LCDS) 2030 with BRI. Beijing is expected to further leverage investments under the BRI, as seen already in significant infrastructure deals, including in railways, road networks, and the expansion of the Cheddi Jagan International Airport (GEO).

China’s engagement in Guyana’s oil sector has been largely limited to China National Offshore Oil Company’s (CNOOC) 25 percent partnership in the US-based oil company-led consortium in Stabroek Block. Bilateral engagements in the energy sector, however, have the potential to steadily grow in the medium-to-long term, especially with Ali inviting China-based oil companies to participate in the auction of 14 new oil blocks in September 2023. A Chinese company undertaking the construction of a deepwater port in Berbice and Huawei’s investments in telecommunications and surveillance sectors suggests Beijing’s increasing involvement in Georgetown’s strategic infrastructure projects, which are expected to play a pivotal role to support its growing economy.

The deepening Guyana-China bilateral ties reflect limitations in Guyana-USA relations to further grow, with the latter, albeit longstanding, largely being confined to Washington’s energy investments and security cooperation. The status quo is unlikely to change in the near-to-medium term, with Ali expected to tow a balancing act amid the need to bolster the country’s weak infrastructure, the energy growth driven by oil investments, and the territorial dispute with Venezuela demanding stronger US support.

Domestic Factors Influencing Oil & Gas Sector

Ethnic Tensions

Since gaining independence from the UK in 1966, Guyana’s socio-political has been characterized by power-sharing disputes between two major ethnic groups. The Indo-Guyanese, of Indian origin and historically aligned with the ruling left-wing People’s Progressive Party (PPP), constitute approximately 40 percent of the population. On the other hand, the Afro-Guyanese communities (30 percent of total population) are the traditional support base of the A Partnership for National Unity (APNU) opposition alliance.

Tensions between the two parties following the 2020 election have largely subsided. However, the opposition parties’ alleged exclusion from the Natural Resource Fund and significant positions in the government, business, and public sectors suggest that that potential for political tensions will persist due to the apparent demographic divide. This is also supported by the APNU accusing Irfaan Ali’s government (PPP) of directing oil wealth towards its supporters, the Indo-Guyanese community, while allegedly neglecting the Afro-Guyanese and other ethnic groups.

However, there is limited potential for the ethno-political tensions to majorly spill over to the oil and gas sector beyond the political rhetoric. This is likely because the economic prosperity driven by the oil and gas sector, including infrastructure development and steadily declining unemployment rates, is of shared interest across the ethnic divides. President Irfaan Ali’s 69 percent approval rate reported in November 2023, further supports the same. Despite Ali announcing a 6.5 percent salary increase in 2023, pressure, mainly from the Afro-Guyanese dominated public sector over higher wages will persist amid increasingly rising government revenues, largely stemming from foreign investments. This could potentially lead to sporadic work-stoppages in the education and health sector.

Environmental activism

Guyana has witnessed low levels of environmental activism in recent years, with associated protests being infrequent, largely non-disruptive, and seemingly symbolic. Most of the demonstrations have been centered around climate change, oil spills, and the adverse impacts of oil and gas refineries, among other issues. On February 14, 2023, a group of local activists loosely affiliated with environmental activities, ranging in the high dozens, held a demonstration outside an energy exposition in Umana Yan, George. The protesters demanded accountability from private oil companies over “rampant” oil spills and highlighted the perceived lack of adherence to Guyana’s environmental laws like the Environmental Protection Act. These small-scale demonstrations are often witnessed in and around energy and oil conferences held in Georgetown. This is also supported by another protest by a dozen participants reported outside an oil conference hosting multiple private companies in Georgetown on February 16, 2022.

Based on December 2023 reports indicating that Guyana will be open to more oil investments from India and Europe, low-to-moderate levels of environment-related activism over alleged exploitation by private oil companies may recur. However, against the backdrop of narrowing unemployment and increased potential for socio-economic and civic projects resulting from oil investments and corporate social responsibility (CSR) initiatives, the likelihood of large-scale activism/protests in the country will remain low.

Climate change

Guyana faces significant climate vulnerabilities, primarily stemming from its low-lying geography and susceptibility to coastal flooding. Given that 90 percent of the population reside in low-lying regions along the Atlantic coast and the capital, Georgetown, lies below sea level, rising sea levels pose an imminent threat. The existing seawalls, which have historically protected against ocean incursions, may become inadequate as the frequency and severity of coastal flooding increases. Furthermore, Guyana’s vulnerability extends to the practice of deep-water offshore drilling, with potential oil spills posing a threat to the country’s rich biodiversity and rainforests.

Therefore, judicial scrutiny and accountability on the environmental impact of offshore investments will persist as investments grow. This is reflected in a May 2023 court order insisting the US-based oil company to provide an “unlimited guarantee” to cover the cost of a potential oil spill. The appeals court, however, stayed the order in June 2023, on the condition that the company will provide a 2 billion USD guarantee in 10 days, thereby limiting the liability albeit with stricter mandates in the event of an oil spill. Judicial oversight of the seemingly business-friendly Ali-led government, especially its Environmental Protection Agency, will persist vis-a-vis environmental audits for energy projects. This, in turn, may marginally increase environmental insurance costs for companies in the long term, especially with Guyana aiming to meet climate change plans under the LCDS 2030 through growing investments in the energy sector. Thus, to meet net zero targets and circumvent impacts of climate change on the growing potential of oil production, the government is expected to aggressively push carbon credits plans to shore up investor confidence in the coming years.

Outlook

The increasing investment potential of Guyana’s energy sector will continue to drive high GDP growth in the coming years, with the UN projecting the country to become the world’s fourth-largest offshore oil producer by 2035. Territorial tensions with Venezuela over Essequibo are likely to persist, which may limit or delay the prospects of offshore exploration in the disputed region. Overall, the socio-political landscape is expected to remain stable due to narrowing unemployment and anticipated economic benefits from investments in the sector.

Highlights

- While military escalations in the Guyana-administered Essequibo region remain unlikely, the potential for intimidatory tactics by Caracas against oil facilities cannot be ruled out.

- Deepening ties between Guyana-China under the BRI Initiative increases scope for greater bilateral engagements in the energy sector.

- Despite the political impact of ethnic tensions between Indo-Guyanese and Afro-Guyanese groups, the energy sector is unlikely to be negatively affected due to the shared economic interests in the sector.

- Increased judicial scrutiny on environmental impact assessments may marginally elevate insurance costs for companies.

Introduction

- Guyana, the world’s fastest-growing economy, achieved its inaugural commercial crude oil draw in December 2019, solidifying its status as one of the newest petroleum-producing regions globally. Historically, as a net fuel importer, with its offshore Guyana Basin and inland Takatu Basin, Guyana has drawn the interest of foreign oil companies since the 1940s, conducting extensive geological surveys and drilling wells.

- A September 2023 report by the International Monetary Fund (IMF) on Guyana’s economy underlines that the country’s economy continues to develop extremely “rapidly” as a result of the government’s modernization programs, which are mostly supported by money generated from the expansion of the oil industry.

- National oil in 2023 generated one billion USD in yearly income and is expected to generate 7.5 billion USD by 2040. With predicted oil production increases, Guyana is on track to become the world’s fourth-largest offshore oil producer.

- In 2023, Guyana’s real GDP expanded by 33 percent, while the non-oil, real economy expanded by 11.7 percent.

Geopolitics

While alternative forms of energy exploration including fossil fuels and biomass are predicted to expand, Guyana’s crude oil industry will continue to dominate the commercial oil market, especially following its expansive crude oil explorations in 2015 and 2019. This is particularly likely as global players, including Canada, the UK, USA, as well as China, will seek to further diversify conventional energy sources amid the expected long-term market volatility stemming from the Middle East and the Russia-Ukraine conflicts.

Given Guyana’s successful exploration campaigns and production of one million barrels of commercial crude oil per day (with an expectation of 1.2 million barrels of crude oil per day by 2027), the country will possibly stand to challenge OPEC+’s influence in the global supply chain market, which has been announcing production cuts in a bid to control crude prices. This is supported by the country’s expansionist oil projects and drilling campaigns growing at a steady pace. Some examples of this include the Payara offshore project already producing 220,000 barrels per day as of January 2024 and the approval of the consortium of the Uaru project expected to produce 250,000 barrels per day in 2026.

Territorial tensions with Venezuela

Guyana’s longstanding territorial dispute with Venezuela over the hydrocarbon-rich Essequibo region, despite the January 25 pledge by both countries to maintain peace, will continue to be an underlying concern for the energy sector through the medium term. This mainly stems from the diplomatic escalations following the Caracas-led referendum in Essequibo in December 2023, with Venezuelan Defense Minister Vladimir Padrino announcing on February 9 to conduct a “proportional, forceful” operation against proposed oil drilling in the contested region.

Guyanese President Irfaan Ali has asserted that oil drilling operations will proceed according to the original plan. Given this, Caracas will likely continue to adopt intimidatory tactics in the form of increased military deployment near its borders, especially as an attempt to shore up domestic public appeal with President Nicolas Maduro seeking re-election in July 2024 elections amid Venezuela’s dire economic situation. Increased Venezuelan military presence was reported at its Anacoco Island Base on January 13 and Punta Barima in early-February, alongside improvement of roads and other infrastructural facilities near the two areas. Based on precedent, the possibility of Venezuelan Navy-led interceptions of an oil company’s ship off the Essequibo region cannot be entirely ruled out, especially if a project materializes in Guyana’s Exclusive Economic Zone, disputed by Caracas. For instance, in December 2018, a Venezuelan military helicopter attempted to land on the deck of an US-based oil company’s contracted vessel within the Stabroek Block. In October 2013, Venezuelan Navy detained the crew of a Texas-based petroleum company’s vessel conducting a seabed survey off Essequibo for “carrying out illegal activities”. Similar attempts remain possible in the coming months, especially with the US-based company announcing plans on February 9 to explore two new offshore exploratory wells in the Stabroek Block.

As a result, increased Guyanese military preparedness can also be expected going forward, especially with Ali announcing to increase the 2024 defense budget. Joint military drills between Guyana and the UK and the USA also remain likely. Despite this, the potential for a Caracas-led military confrontation will continue to remain limited, especially as such a move will severe the prospects of temporarily eased Washington-led sanctions on Venezuela’s oil, gold, and secondary financial markets, due a review in April.

Against the backdrop of the ongoing Essequibo conflict, Guyana will likely continue to limit operations and exploration activities, particularly those near Venezuelan waters, specifically above the “70-degree line” of their borders. This is supported by the Guyanese officials announcing on February 21 to refrain from approving energy activities south of the delimited waters until the International Court of Justice makes a ruling on the territorial dispute concerning the Essequibo region. This indicates Georgetown’s cautious approach, aimed at avoiding further escalation of tensions with Venezuela.

Ties with China

Guyana and China released a joint statement conveying their willingness to cooperation under the Belt and Road Initiative (BRI) on July 31, 2023. This increased cooperation is also manifested in Ali committing to linking Guyana’s Low Carbon Development Strategy (LCDS) 2030 with BRI. Beijing is expected to further leverage investments under the BRI, as seen already in significant infrastructure deals, including in railways, road networks, and the expansion of the Cheddi Jagan International Airport (GEO).

China’s engagement in Guyana’s oil sector has been largely limited to China National Offshore Oil Company’s (CNOOC) 25 percent partnership in the US-based oil company-led consortium in Stabroek Block. Bilateral engagements in the energy sector, however, have the potential to steadily grow in the medium-to-long term, especially with Ali inviting China-based oil companies to participate in the auction of 14 new oil blocks in September 2023. A Chinese company undertaking the construction of a deepwater port in Berbice and Huawei’s investments in telecommunications and surveillance sectors suggests Beijing’s increasing involvement in Georgetown’s strategic infrastructure projects, which are expected to play a pivotal role to support its growing economy.

The deepening Guyana-China bilateral ties reflect limitations in Guyana-USA relations to further grow, with the latter, albeit longstanding, largely being confined to Washington’s energy investments and security cooperation. The status quo is unlikely to change in the near-to-medium term, with Ali expected to tow a balancing act amid the need to bolster the country’s weak infrastructure, the energy growth driven by oil investments, and the territorial dispute with Venezuela demanding stronger US support.

Domestic Factors Influencing Oil & Gas Sector

Ethnic Tensions

Since gaining independence from the UK in 1966, Guyana’s socio-political has been characterized by power-sharing disputes between two major ethnic groups. The Indo-Guyanese, of Indian origin and historically aligned with the ruling left-wing People’s Progressive Party (PPP), constitute approximately 40 percent of the population. On the other hand, the Afro-Guyanese communities (30 percent of total population) are the traditional support base of the A Partnership for National Unity (APNU) opposition alliance.

Tensions between the two parties following the 2020 election have largely subsided. However, the opposition parties’ alleged exclusion from the Natural Resource Fund and significant positions in the government, business, and public sectors suggest that that potential for political tensions will persist due to the apparent demographic divide. This is also supported by the APNU accusing Irfaan Ali’s government (PPP) of directing oil wealth towards its supporters, the Indo-Guyanese community, while allegedly neglecting the Afro-Guyanese and other ethnic groups.

However, there is limited potential for the ethno-political tensions to majorly spill over to the oil and gas sector beyond the political rhetoric. This is likely because the economic prosperity driven by the oil and gas sector, including infrastructure development and steadily declining unemployment rates, is of shared interest across the ethnic divides. President Irfaan Ali’s 69 percent approval rate reported in November 2023, further supports the same. Despite Ali announcing a 6.5 percent salary increase in 2023, pressure, mainly from the Afro-Guyanese dominated public sector over higher wages will persist amid increasingly rising government revenues, largely stemming from foreign investments. This could potentially lead to sporadic work-stoppages in the education and health sector.

Environmental activism

Guyana has witnessed low levels of environmental activism in recent years, with associated protests being infrequent, largely non-disruptive, and seemingly symbolic. Most of the demonstrations have been centered around climate change, oil spills, and the adverse impacts of oil and gas refineries, among other issues. On February 14, 2023, a group of local activists loosely affiliated with environmental activities, ranging in the high dozens, held a demonstration outside an energy exposition in Umana Yan, George. The protesters demanded accountability from private oil companies over “rampant” oil spills and highlighted the perceived lack of adherence to Guyana’s environmental laws like the Environmental Protection Act. These small-scale demonstrations are often witnessed in and around energy and oil conferences held in Georgetown. This is also supported by another protest by a dozen participants reported outside an oil conference hosting multiple private companies in Georgetown on February 16, 2022.

Based on December 2023 reports indicating that Guyana will be open to more oil investments from India and Europe, low-to-moderate levels of environment-related activism over alleged exploitation by private oil companies may recur. However, against the backdrop of narrowing unemployment and increased potential for socio-economic and civic projects resulting from oil investments and corporate social responsibility (CSR) initiatives, the likelihood of large-scale activism/protests in the country will remain low.

Climate change

Guyana faces significant climate vulnerabilities, primarily stemming from its low-lying geography and susceptibility to coastal flooding. Given that 90 percent of the population reside in low-lying regions along the Atlantic coast and the capital, Georgetown, lies below sea level, rising sea levels pose an imminent threat. The existing seawalls, which have historically protected against ocean incursions, may become inadequate as the frequency and severity of coastal flooding increases. Furthermore, Guyana’s vulnerability extends to the practice of deep-water offshore drilling, with potential oil spills posing a threat to the country’s rich biodiversity and rainforests.

Therefore, judicial scrutiny and accountability on the environmental impact of offshore investments will persist as investments grow. This is reflected in a May 2023 court order insisting the US-based oil company to provide an “unlimited guarantee” to cover the cost of a potential oil spill. The appeals court, however, stayed the order in June 2023, on the condition that the company will provide a 2 billion USD guarantee in 10 days, thereby limiting the liability albeit with stricter mandates in the event of an oil spill. Judicial oversight of the seemingly business-friendly Ali-led government, especially its Environmental Protection Agency, will persist vis-a-vis environmental audits for energy projects. This, in turn, may marginally increase environmental insurance costs for companies in the long term, especially with Guyana aiming to meet climate change plans under the LCDS 2030 through growing investments in the energy sector. Thus, to meet net zero targets and circumvent impacts of climate change on the growing potential of oil production, the government is expected to aggressively push carbon credits plans to shore up investor confidence in the coming years.

Outlook

The increasing investment potential of Guyana’s energy sector will continue to drive high GDP growth in the coming years, with the UN projecting the country to become the world’s fourth-largest offshore oil producer by 2035. Territorial tensions with Venezuela over Essequibo are likely to persist, which may limit or delay the prospects of offshore exploration in the disputed region. Overall, the socio-political landscape is expected to remain stable due to narrowing unemployment and anticipated economic benefits from investments in the sector.